How The Conscious Accountant Transformed Her Business with Profit First

In this episode, Tim Seymour chats with Hetty Verney — The Conscious Accountant — about how discovering Profit First in 2019 completely changed her business and her life. Hetty shares how implementing Profit First brought her clarity, peace of mind, and the confidence to finally reward herself for her hard work.

Now a certified Profit First Professional, Hetty helps her clients achieve the same transformation — turning financial chaos into structure, profit, and calm. She also reveals how simple routines like her weekly “Finance Friday” create lasting accountability and sustainable growth.

Tune in to discover how Profit First can shift your mindset, your money, and your business.

Transcript

Welcome to Profit first beyond the Book, a podcast that's Profit first brought to you by Tim Duncan and the rest of the Profit First Professionals, UK and Ireland.

Speaker A:Today, I am really pleased to be joined by one of our longest standing Profit first professionals over here in the UK in Ireland, Hetty Verney, who is also known as the Conscious accountant.

Speaker A:So, Hetty, welcome along.

Speaker A:Thank you for joining me today.

Speaker B:Thank you so much.

Speaker B:I'm very excited to be here today.

Speaker A:Well, we've known each other a long time, Hetty, and we both, we both went through Profit first certification through the US Model, didn't we?

Speaker B:We did.

Speaker A:So.

Speaker A:So we come across each other before me and Duncan took the license on.

Speaker A:So it's always a pleasure having you talking to us, but also when you join our community calls because you've got so much value and knowledge and experience to share with the rest of the community, which you do so willingly as well.

Speaker A:So I thank you for that.

Speaker B:Not at all.

Speaker B:I love sharing my story advice.

Speaker B:If I could, if I give it.

Speaker A:Brilliant.

Speaker A:Thanks.

Speaker A:Well, we're gonna go.

Speaker A:We're gonna go.

Speaker A:So we're going to learn about you today, Hattie.

Speaker A:We're going to let everybody learn a little bit more about who Hetty is and, and, you know, what's, what's driven you to this point.

Speaker A:So can you talk to us about your journey before you discovered Profit First?

Speaker A:You know, what did you do before all this, all of this became sort of real life.

Speaker B:Goodness.

Speaker B:It's been so much part of my life for such a long time.

Speaker B:It was a while ago, so I've been an accountant for 26, 27 years now, and I was just bumbling along absolutely fine, paying myself reasonable ish salary, but nothing, nothing that I really wanted to.

Speaker B:Didn't ever seem to be able to grow the business.

Speaker B:Didn't really know what was happening, where it was going.

Speaker B:It was just bumbling along, basically, which was okay, but not where I wanted to be.

Speaker B: I came across Profit first in: Speaker B:Let me have a look at it and just see what's going on here.

Speaker B:So I read the book, then I read the book again, then I read the book again, and then I thought, okay, fine, so I can do this.

Speaker B:This is absolutely fine.

Speaker B:So I did it exactly as the book said, and it was, it was okay, but it just didn't quite work for me, being a UK limited company.

Speaker B:And it just, just didn't work quite right.

Speaker B:So I tweaked it changed.

Speaker B:It moved it around.

Speaker B:Specifically the allocations on the 10th and the 25th that Mike suggests, which I gather is absolutely perfect.

Speaker B:Perfect if you're in America, but if you're in the uk.

Speaker B:It didn't work for me and my business.

Speaker B:My.

Speaker B:My clients paid me throughout the month.

Speaker B:And so I decided to.

Speaker B:And initially I set it up on a monthly basis that didn't quite work.

Speaker B:So then I set it up on a weekly basis and that really worked.

Speaker B:And it gave me such an enormous peace of mind from day one that I was already putting this money aside into separate accounts, separate pots, and it was working for me.

Speaker B:I started doing it in the.

Speaker B: In September: Speaker B:So at the end of September, when I took my first profit distribution, 50% of whatever was in my profit account wasn't a huge amount in there at that particular point.

Speaker B:But I have to tell this story because it's.

Speaker B:It's one of the things that really inspires a lot of clients that I work with.

Speaker B:I, as I said, I didn't have a huge amount of money in that account at that time, but I went and bought a bottle of rose, piece of carrot cake, and a magazine that I'd been wanting to buy for a while, which was, to me, at that point, very expensive.

Speaker B:I went to the rose, ate all the carrot cake, read my magazine, and I'm not ashamed to admit it, I was in tears.

Speaker B:It was the first time I had ever, ever in that, at that time, rewarded myself for running my business.

Speaker B:I paid myself minimum salary, but I paid myself, but I'd never actually rewarded myself.

Speaker B:And suddenly being able to do this was like, wow, this is what it's all about.

Speaker B:Okay, okay, so how can I change it and tweak it and adapt it so that it really works for me so that I can.

Speaker B:Then eventually, I hadn't even thought about getting certification at this point.

Speaker B:I just thought, how can I do this basically for my business?

Speaker B:And so I tweaked things and changed things a little bit.

Speaker B:So it worked for me.

Speaker B:And then I decided to sign up for the certification because I thought, this is going to be unbelievably good for my clients.

Speaker B:And I immediately thought of about six clients straight off that they would love it, absolutely love it.

Speaker B:That went into Covid and all the lockdown, lovely things that we had to do then.

Speaker B:And I suddenly took on an enormous amount of other clients.

Speaker B:Most of my clients before that had been quite local to me in Gloucestershire.

Speaker B:And suddenly I was taking on clients all over the country remotely and I'd never done anything like this before and I thought, okay, fine, so not only can I need tell all these clients about what they're eligible for, etc, during lockdown and furloughs and all of that lot, but actually I can teach them how to use Profit first now because I'm certified.

Speaker B:And so that's what I started doing.

Speaker B:And I started doing online courses on it and webinars on it and all sorts of things.

Speaker B:Things because I realized at that point that if I hadn't had Profit first set up and running in my business, I may not have survived lockdown or I might have survived it, but literally just survived.

Speaker B:And I certainly wouldn't have thrived if I hadn't already put it in place.

Speaker B:So it stood me in incredibly good, steady.

Speaker B:And it started helping so many of my new clients that I was taking on the older clients.

Speaker B:It was more difficult to get them involved because they were like, we are in panic mode.

Speaker B:We've just got to get on and survive right now.

Speaker B:We can't think about setting up new systems and stuff like that.

Speaker B:And I was like, okay, that's fine.

Speaker B:Since then, most of them have actually come on anyhow, which is great.

Speaker B:But being able to show my clients because I had done the certification because I was running it in my business, it meant such a lot to them to see how successful it was for me and how easy it was for them to set it up and get it up and running for them once they realized that it was a behavioral system.

Speaker B:And actually it was going to help them so much in their business, but also in their personal lives as well because they were starting to set up profit first in their personal lives as well.

Speaker B:That it was, it was, it was a no brainer and it was a complete no brainer to me.

Speaker B:Any, any new client that comes on to on with me now, they will be setting up Profit first, end of story.

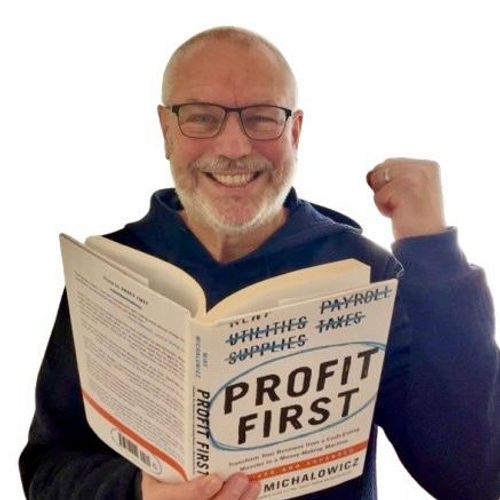

Speaker B:Even if they don't set it up immediately when they start working with me, they will be setting it up because I talk about it so much and the amount of times they look at me and say, what's that book in the background?

Speaker B:I've heard of Profit first but I've never really understood it.

Speaker B:Isn't it just a fad?

Speaker B:No, it's not a fad.

Speaker B:It's an amazing cash management system that helps you manage your cash completely.

Speaker B:And once they start realizing quite how easy it is and how quick it is for them to do this, and I mean my, my weekly allocations, I have a, I Call it my finance Friday.

Speaker B:I don't work with clients on Fridays.

Speaker B:Usually at 10 o' clock on a Friday, I will go through all my zero and my go card list and everything else, make sure everything is up to date and sorted and I will organize my profit first allocations and it literally, it'll take me 10 minutes.

Speaker B:10 minutes.

Speaker B:To give you the peace of mind is just like, why wouldn't you do it?

Speaker B:It's a complete, utter game changer.

Speaker B:It really is.

Speaker B:And last last Christmas, well, last, I suppose it was last June when I took my profit allocation out, I'd put enough aside to pay for my son, my younger son and myself to go to New Zealand to see my eldest son, who we hadn't seen since before COVID at that point.

Speaker B:And we pay.

Speaker B:I paid for everything, all the accommodation, the flight, the food, the excursions, the whole lot.

Speaker B:Not only that, we actually upgraded to business class for the whole flight, which was unbelievable purely purely because of Profit first.

Speaker B:And that was unbelievable to be able to do that for.

Speaker B:If I hadn't set up Profit first, yes, I might have had that money in my account, but it would have been there and I probably would have spent it on things that I really didn't need, mostly on Amazon, I expect, but I certainly wouldn't have thought of putting it into a separate account.

Speaker B:Now I have a lot of clients who first start with me and they say, oh, yeah, well, we already put aside however much as a fixed fee into an account for our tax.

Speaker B:And I'm like, what happens if you have a really bad month?

Speaker B:And they're like, oh, well, it doesn't happen.

Speaker B:And I said, so then when you have to pay your tax, you haven't got enough.

Speaker B:This is why profit was worse, because it's a percentage and whatever, whether your income is down or up or whatever it's doing, it is a percentage of that income.

Speaker B:And that's why it works so brilliantly.

Speaker B:Once I got it up and running with my clients, I then became a belief coder.

Speaker B:So I work on people's mindset because so many people have issues about, oh, I can't do numbers, I hate spreadsheets or that.

Speaker B:So I help them work through those blocks in order to be able to be clear enough to run Profit first.

Speaker B:And it makes, it's, it's a game changer.

Speaker B:Every single client that I have, every single one that's on Profit first says that they are so grateful that they've got it up and running and sorted for them and it makes such A difference.

Speaker B:And it means they can sleep at night.

Speaker B:They know that their tax is already put aside.

Speaker B:They know that they're paying themselves not just the basics, but they're actually paying themselves what I call their wants, not their needs.

Speaker B:And that's the difference with.

Speaker B:With Profit first and becoming a certified professional and being able to help those people is just.

Speaker B:It's so unbelievably rewarding.

Speaker B:It really is.

Speaker B:People who've had issues with HMRC because they've owed tax for God knows how long, and they're like, well, I've got this huge tax bill to pay, and I've got last year's tax, which I still haven't paid.

Speaker B:And I'm like, it's okay.

Speaker B:It's fine.

Speaker B:We'll get Profit first set up so that we're set up for next year's tax, but we'll also get that debt cleared as quickly as we possibly can as well.

Speaker B:And they're like, oh, okay, that's fantastic.

Speaker B:So I wouldn't be without Profit First.

Speaker B:I really wouldn't.

Speaker B:I'm just.

Speaker B:I'm so unbelievably grateful for the person who introduced me to the book in the beginning.

Speaker A:I'm totally with you on that one.

Speaker A:I.

Speaker A:And the guy who.

Speaker A:Who introduced me to the book is called Nick Hayward, and he was one of my clients.

Speaker A:And again, eternally grateful for that to have happened.

Speaker A:Heti, I love hearing you talking about your first reward from Profit first to your latest reward from accumulation of.

Speaker A:Of profit, you know, rewards.

Speaker A:And I remember you telling us at Profitcon24 in London, you've got.

Speaker A:We.

Speaker A:We asked you to come up on stage, and you.

Speaker A:And that was before you went to New Zealand.

Speaker A:And the fact that you were going out there to see your son for the first time for a long time, you got quite emotional and understandably so.

Speaker B:And.

Speaker A:And that.

Speaker A:That it just underpins the point that Profit first does change lives, and it is a game changer.

Speaker A:You use the word game changer a lot when you talk about Profit first first.

Speaker A:And I think it's transformative, you know, and.

Speaker A:And it's caused this transformation for you to better do these things.

Speaker A:Like you said, rather than fritting money away on Amazon or.

Speaker A:Or wherever else that the money would disappear to.

Speaker A:And.

Speaker A:And the fact that you live and breathe Profit first in your business, that has a massive factor in how you can then help your clients, doesn't.

Speaker B:Oh, gosh, yeah.

Speaker B:Enormous.

Speaker B:Absolutely enormous.

Speaker B:I mean, I'm working as a fractional CFO for a few companies now.

Speaker B:So it's changed from just being an accountant and a bookkeeper, as I was, but being able to bring profit first into these larger companies who've been going for years and years and years.

Speaker B:They're very, very successful.

Speaker B:Everything's been going wonderfully.

Speaker B:But then suddenly they've got a bat bill and they haven't put the money aside.

Speaker B:And I'm like, well, why haven't you, why haven't you done this?

Speaker B:And they're like, we've never heard of profit first, but you could still put the money aside, but we wouldn't know how to start.

Speaker B:Right?

Speaker B:Okay, fine.

Speaker B:So not only do I help them with all their forecasting and their reorganizing their financial departments, which is what I usually do, but now setting up profit first and getting their staff trained to use profit first as well is just, it's, it's brilliant.

Speaker B:It's absolutely brilliant.

Speaker B:So it doesn't just work for the little people, it works for everybody.

Speaker A:Is that, that's a really interesting point, isn't it?

Speaker A:Because we do get asked these questions, don't we?

Speaker A:It's not for big businesses, it's only for small businesses or the other way around.

Speaker A:It's only, it's only for big businesses, not for small.

Speaker A:It's for everybody, isn't it?

Speaker A:It's, it doesn't matter.

Speaker B:Everybody from day one.

Speaker A:Yes, absolutely.

Speaker A:Because it's percentage based.

Speaker A:It doesn't matter how much the money is.

Speaker A:We're talking percentages, percentages of percentages.

Speaker A:And then we can increase those percentages as, as we go along.

Speaker A:So it's a really good point.

Speaker A:And you know, so your clients that you're working with, you must have some tremendous success with them.

Speaker A:And I understand the ripple effect and how.

Speaker A:Well, how good it makes you feel doing this job with them.

Speaker A:Have you got any examples from your client's perspective of how they feel?

Speaker B:Goodness, yeah, I have actually.

Speaker B:I have a client who I've been, who's been with me now for probably about four, five years, probably.

Speaker B:I think it is something like that now.

Speaker B:And when he came to me, he has three children in private school and he was taking basic salary and dividends but pretty small amounts.

Speaker B:And he said, I don't want to set this up in the business, I want to set this up personally so that I've got enough to pay the kids school fees.

Speaker B:So I said, okay, fine, let's just do that to start with.

Speaker B:So we started doing that for him and the kid.

Speaker B:Kids expenses got higher and higher as the children Got older, obviously.

Speaker B:And um, and he was like, well, I need to change my percentages because I haven't got enough going in.

Speaker B:And I said, okay, that's absolutely fine, we can do that.

Speaker B:He was like, oh, what?

Speaker B:Just like that?

Speaker B:And I said, yeah, I'll work it out and we'll work out what the percentages need to be.

Speaker B:Oh.

Speaker B:He then came back to me and this was after about 18 months of working with him on the private side.

Speaker B:He then came out to me and said, okay, so you're going to tell me that I really need to get profit first set up in the business now, aren't you?

Speaker B:Been running my accounts for the last two years or whatever it was.

Speaker B:And I've been very, very not distracted, but very dismissive that it wasn't going to work for the business.

Speaker B:But he said, I've, I've seen how it worked personally, so let's just give it a go and see how we do.

Speaker B:So I said, okay, fine.

Speaker B:So at this point he was taking normal dividend, sorry, normal director salary and about 40,000 in dividends, roughly speaking.

Speaker B:He didn't dare take any more because he didn't think he could.

Speaker B:So we worked on the profit first percentages that he needed to do the current allocation percentages and the target allocation percentages.

Speaker B:Within that first year of running it in his business, he'd increased his salary to when salary and dividends to £150,000.

Speaker B:His profit had gone up because we'd done, we did an expense analysis every single quarter.

Speaker B:And because he was a very it heavy company, he had so many subscriptions that he really didn't need.

Speaker B:So we kept on cutting down these expenses and increasing the percentages to his owner's pay.

Speaker B:And he was like, this is unbelievable, I can't believe it.

Speaker B:And he said, my corporation tax, it's, it's gone up enormously.

Speaker B:And I said, yes, it has, but your percentages have gone up too, and they're covering it.

Speaker B:And he said, yeah, I know what this is.

Speaker B:What I don't understand, why didn't I do this before?

Speaker B:And I was like, well, I did try to tell you, but.

Speaker B:So, yeah, he was, he was very happy, very happy indeed.

Speaker B:I do have clients who come to me and say, well, I'm not earning a profit, so how am I going to, how am I going to set it up?

Speaker B:How can I get it working for me?

Speaker B:And we still get it set up and working for them, but basic, tiny, tiny amounts.

Speaker B:And they have to understand that this transformation is not going to happen immediately.

Speaker B:It's going to happen over time.

Speaker B:But the over time bits, the bit that, that lasts, because if it takes a while to get there, you're going to appreciate it an awful lot more when it does get there.

Speaker B:And yeah, I have, I do have a lot of clients who used to come to me with, well, I don't, I don't have any profit, so I can't do profit first.

Speaker B:And I'm like, okay, forget about the name.

Speaker B:And there are quite a few clients who don't like to call it profit first.

Speaker B:They call it, what do they call it?

Speaker B:Reward first, promise first, all sorts of different things.

Speaker B:Because they don't like the word profit because it automatically makes them think, well, I haven't got a profit, so I can't do it.

Speaker B:Yeah, you can.

Speaker B:Yeah, you can.

Speaker B:There's a lot of ways that you can do it.

Speaker B:Anybody can do it.

Speaker B:And as I think we were talking about yesterday, starting it from day one is the best possible time.

Speaker B:Because if you can get into those, the routine and the rhythm immediately, then by the time you've been in business for six months, it's going to be an absolute second nature.

Speaker B:If I don't do my profit first on a Friday morning by Saturday, and I was like, something's missing.

Speaker B:What happened?

Speaker B:I've missed it.

Speaker B:Oh my God.

Speaker B:There's a little bit of an addiction possibly.

Speaker B:But it's funny, isn't it?

Speaker A:It flips it around sometimes and you don't actually want to take the money out of the pot sometimes, do you?

Speaker A:It's there for a reason.

Speaker A:But then your resistance, I know it's there for a holiday, but I'm not sure I want to spend it right now or, or, you know, whichever purpose it's there for, you know, in your personal life.

Speaker A:But yeah, I love, I love that story about your client who, it's quite unusual to hear it the way around you've explained it.

Speaker A:Most people work with, with the business, then they go into the personal side of the.

Speaker A:But obviously they're so correlated because it's all about the owner rewarding themselves from the business.

Speaker A:So it's a great angle to go at in that scenario to, to sort them out personally.

Speaker A:But then obviously once you organized his business and he was earning even more money, then the personal side is just, you know, it's flowing so beautifully well for him then, isn't it?

Speaker A:So it's a great, great example of a client.

Speaker B:I, I do, we do a joint business plan when I start working with a client, but It's a totally integrated personal and business plan.

Speaker B:So how many holidays are you waiting wanting to have?

Speaker B:Sorry, the dog's jumping up.

Speaker B:How many holidays do you want to have?

Speaker B:How much salary and dividends do you want to be able to take?

Speaker B:What's that going to mean for you personally?

Speaker B:And trying to integrate the two, because when you're running your own business, they're one and the same.

Speaker B:They have to be.

Speaker B:And if you're looking at a business plan just as a business plan that doesn't integrate, it doesn't work.

Speaker B:It doesn't.

Speaker B:You can't work on the values and the purpose of whatever it is that that person is trying to do in their business.

Speaker B:If you don't integrate the two together and being able to use Profit first in your business and personally, it's just.

Speaker B:Yeah, it's, it is a game changer.

Speaker A:Yeah, without doubt.

Speaker A:I absolutely love that.

Speaker A:And, and it's so clear the, the passion and the care that you have for your clients and you really, it comes across the way you're talking about them, how well you want them to do, which is really, it doesn't surprise me because I've known you a lot, I know a fairly long time now through Profit first.

Speaker A:But it also doesn't surprise me from the aspect of our community because our community is full of giving, caring people.

Speaker A:And it seems to be the people that are attracted to Profit first, the people that are attracted to joining Profit first professionals just tend to be people that want to share their knowledge and their experience with everybody so that everybody can be successful.

Speaker A:And it just flows down and that, that ripple effect when you hear someone is worked with a client and the client's finding success and then they're telling someone who's then working with the member and they're finding success.

Speaker A:It's just, it makes you feel good.

Speaker A:And like you alluded to, profit can be dubbed a dirty word.

Speaker A:But I totally agree with you.

Speaker A:It doesn't have to be called profit first.

Speaker A:You can call it whatever you want, whatever the purpose is for that, for that person.

Speaker A:It can be that, it could be holiday first, it could be house first, it could be whatever you want it to be that serves you in your business and you and your personal life, couldn't it?

Speaker B:Yeah, absolutely.

Speaker B:It doesn't matter what you call it, as long as you do it.

Speaker B:Basically.

Speaker B:I'll tell you something else about the, the, the Profit first professional community is the lack of competition.

Speaker A:Yeah.

Speaker B:There is no competition.

Speaker B:There is only collaboration.

Speaker B:And to me that is absolutely key.

Speaker B:Because I don't want to be sharing questions and things like that with somebody who I think is gonna steal my ideas or anything like that.

Speaker B:I want to be able to collaborate with those people in order to be able to give them as much as possible, but so that they can help me as well.

Speaker B:I mean, the questions I was asking yesterday, it was brilliant that I was.

Speaker B:I was answered within about 2 seconds flat.

Speaker B:Jason and Gary, yep, this is what you should be doing.

Speaker B:This is how we would do it.

Speaker B:And to me, that was like, okay, that's how it should be.

Speaker B:That's what I like.

Speaker A:It's gold dust, isn't it, that community been able to ask those questions and get those answers.

Speaker A:And that leads us on to, you know, if there is an accountant, bookkeeper, or coach listening that have maybe read Profit first, sort of wondered about what it's like being in Profit first, professional, what.

Speaker A:What would you say to them?

Speaker B:Don't wait.

Speaker B:The amount of people who have certified who said, wish to God I'd done this years ago, and the amount of clients who said to me, why didn't I do this when I first heard about it?

Speaker B:Or, why didn't I do this five years ago?

Speaker B:Or whatever is.

Speaker B:It's huge.

Speaker B:But anyone who is thinking, oh, gosh, is it actually going to be any good?

Speaker B:Is it going to be any use?

Speaker B:Yes, absolutely.

Speaker B:Not just for the Profit Con Conference, which was brilliant, but because of the.

Speaker B:The fact that everybody just shares every piece of information that they have, every piece of advice they have, what's worked for them, what's not worked for them, and you can ask any questions at all, and it's just unbelievably helpful.

Speaker B:And you and Duncan and Jason have just been so brilliant with setting this up for the UK and getting a license for that.

Speaker B:It just makes so much difference.

Speaker B:It really does.

Speaker B:The US Side was.

Speaker B:Was fine.

Speaker B:It was okay, but it wasn't fabulous.

Speaker B:This is.

Speaker B:This is very different.

Speaker B:Very different indeed.

Speaker A:Thank you, Hetty.

Speaker A:I appreciate that.

Speaker A:Yeah.

Speaker A:And.

Speaker A:And it's a joyous thing to do as well, by the way.

Speaker A:It's like, I don't feel like I work anymore.

Speaker A:I just jump on calls and chat to people and.

Speaker A:And try and support and guide them in the right direction, and they do the rest.

Speaker A:But then we come back and have these wonderful conversations, which is, you know, very fulfilling from our perspective.

Speaker A:And, you know, you know, like, you get the.

Speaker A:I'll use this as an example.

Speaker A:This is probably a bad example, but, you know, so you.

Speaker A:Someone joins the army, they Become a soldier, then they develop really well and they become a Marine, which is fairly elite.

Speaker A:But then they.

Speaker A:They move up from the Marines into Special Forces, which is even the smaller group, and it's like the elite of the elite.

Speaker A:I kind of consider us Profit For First Professionals like that in the accountancy and bookkeeping world, because there's less than 1% of the accounting and bookkeeping world in the UK and Ireland are Profit first professionals.

Speaker A:And I think that makes us special.

Speaker A:And we laughed at profitcon recently because Mike said we were all weird and we're all weirdos, and he was proud to be a weirdo and we were all proud to be weird because if.

Speaker A:If that's what makes us weird, who cares?

Speaker B:Absolutely.

Speaker B:I agree.

Speaker A:Being different is everything, isn't it?

Speaker A:If you want to stand out and do something for your clients that no one else is doing, Profit first gives you all the tools and all the strategies that you can.

Speaker A:You can only dream of.

Speaker A:Really.

Speaker B:Yeah.

Speaker A:So, yeah.

Speaker A:Have you got any Profit first tips you could share with us?

Speaker A:I'm putting you on the spot now.

Speaker A:I know, but is there anything you could share?

Speaker A:So perhaps a business owner is listening rather than accountant or bookkeeper.

Speaker A:What could they do right now?

Speaker B:What can they do right now?

Speaker B:Put 1% of their income into a profit pot.

Speaker B:That's it.

Speaker B:That's all they need to do to start.

Speaker B:Get that into a routine and a rhythm.

Speaker B:Whether that's your finance, Friday or Mondays.

Speaker B:Whatever works for you, stick with what works for you.

Speaker B:Tweak it so that it works for your business.

Speaker B:If it doesn't work for your business, you'll stop doing it.

Speaker B:So the routine and the rhythm to me is absolutely key.

Speaker B:I can take care of the percentages and all the rest of it for them.

Speaker B:That's not a problem.

Speaker B:But the routine and the rhythm, that has to be down to them and make sure that you're held accountable.

Speaker A:That's the key, isn't it, that accountability.

Speaker A:Having some accountability does help the success of Profit first, doesn't it?

Speaker B:Yeah.

Speaker A:I absolutely love that you're proving the system.

Speaker A:Hetty, What.

Speaker A:What kind of businesses do you work with these days?

Speaker B:I work with coaches and consultants and service providers mostly.

Speaker B:I.

Speaker B:As I said earlier, I'm moving towards doing more fractional CFO work.

Speaker B:I have a team who deal with all of my compliance side of things brilliantly, thank God.

Speaker B:So I don't really have to do any of that side of it.

Speaker B:I did a bit that I love, which is helping them be more profitable, making sure that Their systems and their processes and their teams are working as they need to be working.

Speaker B:And if we can get Profit first set up in them as well, then that's a massive bonus.

Speaker A:Always.

Speaker A:Always a massive bonus.

Speaker A:And if anyone wants to find out more about Hetty, you can do via her website, which has come up on the screen now, for those watching the video and the website is HV Associates.

Speaker A:And if you want to catch up with Hetty on LinkedIn, that's fairly straightforward as well.

Speaker A:Just search, go onto LinkedIn, search up HV Associates, and you'll be seeing Hetty's smiling, welcoming face and you'll be able to connect with her and, and maybe, maybe drop a message and ask her how you can get some help from her with Profit First.

Speaker A:I'm sure we would all.

Speaker A:We would all love to work with Hetty in that way.

Speaker A:So, Hetty, I'm so pleased you've joined me today.

Speaker A:Thank you very much for spending half an hour with me.

Speaker A:And thank you to your dog for spending a bit of time in the background as well.

Speaker A:I saw.

Speaker A:I saw him or her walking around a little bit, which is great to see.

Speaker A:We always like the dogs coming on the show as well.

Speaker B:She loves Profit first too.

Speaker B:Thank you so much.

Speaker B:It's been an absolute pleasure talking to you all.

Speaker A:Thanks, Hetty.

Speaker A:Thank you for joining us on our podcast today.

Speaker A:Profit first beyond the book was brought to you by the Profit First Professionals UK and Ireland team.

Speaker A:If you'd like to find out more about Profit first or becoming a Profit First Professional, head to our website, profit first uk.co.uk.