Profit First Insights: Jon Norton Shares His Financial Journey

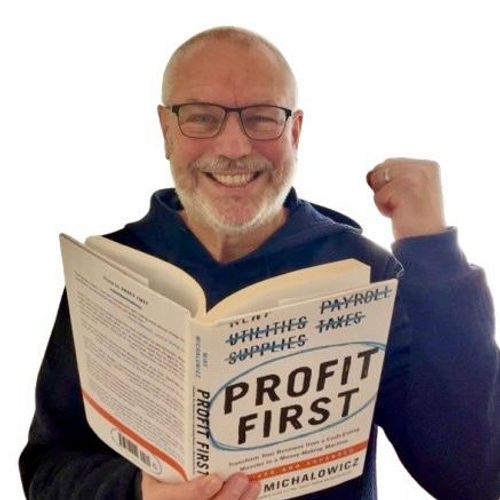

This week, we’re joined by Jon Norton, founder of Barefoot Accounting and certified Profit First Professional, who shares his unconventional path from musician and driving instructor to trusted advisor helping businesses take control of their cash flow.

In this insightful episode, Jon explains how he applies Profit First principles in a variety of business settings — focusing on clarity, simplicity, and long-term sustainability. He reveals how allocating funds intentionally and creating financial buffers allows clients to manage uncertainty without stress or confusion.

Jon’s approach is all about meeting clients where they are, easing them into financial transformation without overwhelm. His story shows that it’s not just about understanding the numbers — it’s about changing habits, reducing anxiety, and building a business that truly works for you.

Key Takeaways:

- Jon’s journey from creative careers to founding Barefoot Accounting.

- Why simplified financial models are more effective for real business results.

- How Profit First creates buffers and breathing room for business owners.

- The power of gradual implementation — and how to ease clients into change.

- Financial clarity as a tool for reducing stress and increasing confidence.

- Why sustainable profit starts with habit-building, not just spreadsheets.

This episode is a must-listen for accountants, bookkeepers, and advisors looking to help clients thrive — and simplify their own business too.

#ProfitFirst #AccountingAdvisory #CashFlowConfidence #BusinessProfitability #Accountants #Bookkeepers #ProfitFirstUK #FinancialClarity

Transcript

Foreign.

Speaker B:Welcome to Profit first beyond the Book, a podcast that takes you beyond the book with Profit first brought to you by Tim Duncan and the rest of the Profit First Professionals UK and Ireland.

Speaker B:Hello John, welcome along.

Speaker A:Hi Tim, thanks for putting up with me.

Speaker B:You're welcome.

Speaker B:Putting up with you.

Speaker B:Love your company John, as always, so thank you very much for joining me.

Speaker B:So John, do you want to just do a brief introduction for us please?

Speaker A:Yeah, no worries.

Speaker A:I'm John of Barefoot Accounting.

Speaker A:I set up the business about 10 years ago having worked in various finance fields and before that I ramon businesses as driving instructor musicians.

Speaker A:So I know the pain of negotiating a business not having a bloody clue and having a bit of a.

Speaker A:Yeah, a last minute panic at the end of January and I've come full circle really.

Speaker A:So now I'm trying to help others negotiate their businesses finances and help them make better decisions with what they're doing.

Speaker B:Brilliant.

Speaker B:Thanks John and welcome along.

Speaker B:And John, how long have you, have you been a Profit First Professional, would you say?

Speaker B:Is it nearly three years now, Two and a half years, something like that?

Speaker A:Yeah, it's coming out to three years now since I signed up with you guys.

Speaker B:Yeah, excellent.

Speaker B:Okay.

Speaker B:And so.

Speaker B:So John, we're going to talk about Profit first, we're going to talk about Profit First Professionals but most and foremost we're going to talk about you or actually you're going to talk about you because we want to learn more about you and learn about your journey that took you to become a Profit first fashion and led you to find out about Profit first in the first place.

Speaker B:So you mentioned that you ran your own business as a driving instructor and a musician.

Speaker B:So can you give us a little bit of info about that first?

Speaker B:Because that's going back to the very beginning really, isn't it?

Speaker B:Let us know your thoughts please.

Speaker A:Many, many years ago I think.

Speaker A:And actually it's funny, I was thinking about, you know, where I joined with Profit first and it started before Profit First Professionals.

Speaker A:Probably reading the book.

Speaker A:I think when I started and ran these businesses it was very hand to mouth, you know, money would come in, then go out and you know that last minute panic of oh, I've got to do the compliance side of things.

Speaker A:And after I've kind of relocated, got a sort of proper job so to speak and moved into accountancy and did a lot of studying.

Speaker A:And it's funny when I think back to when I was running my own businesses, there were various challenges in the way I looked at things and I suppose it curses a professional or expert in a way.

Speaker A:So you go through your accounting training, you see more technical side of it.

Speaker A:It's all profit losses, balance sheet, more technical things.

Speaker A:And even in exams, talking about, you know, international group structures and this, that and the other, which is very far removed.

Speaker A:And if I'm honest, I guess I lost something some of that initial.

Speaker A:This is what's actually facing people day to day.

Speaker A:So when I read the book, which was quite a while ago, actually a penny dropped of why things like management accounts and oh yes, you know, quickbook Zero or whatever, this is so fantastic.

Speaker A:It's got all this reporting why it was missing the mark.

Speaker A:Because I think Mike gives a very candid, you know, view of what he faced through his business.

Speaker A:I guess, you know, his business was more successful than mine, but on the other hand, his stakes would have been higher, which probably made him in more of a situation.

Speaker A:And I think that's something that people should remember.

Speaker A:You know, you grow a bigger business, actually, you know, things are more leveraged.

Speaker A:If something goes wrong, it's going to co catastrophe, you know, catastrophically wrong, if I can say that, rather than just oh, whoops, you know, I'm sure 100 quid on a tax bill.

Speaker A:So is that side of it all.

Speaker A:And through reading the book I could suddenly see, oh yeah, that's how it really does affect the finances, affect it from the business owner perspective, what to do about that.

Speaker A:And after it kind of inspired me a bit, I came up with a bit of a model for simplifying people's business models.

Speaker A:Because I think in many cases, unfortunately, a lot of businesses, they don't think about the business model.

Speaker A:They'll probably say they don't have one, but they do, they just haven't.

Speaker A:You know, every business got a business model, whether it's by design or not.

Speaker A:And I thought, oh yeah, you can simplify something.

Speaker A:And look, what does a business do?

Speaker A:You know, how does it deal with?

Speaker A:To me, there's only two resources really, time and money.

Speaker A:And if you look at the money, there's about four places it can go.

Speaker A:So it allows you to sort of step back and help people see it.

Speaker A:As a business owner, what happens and almost forget about a lot of the technical stuff we learn as accountants.

Speaker A:I'm not saying it's not important, it is.

Speaker A:Especially want to drill more into the details of things, but sometimes you can lose that, you know, more basic.

Speaker A:This is what's happening.

Speaker A:And I mean, I've got a big thing at the moment I'm looking at is I Think a lot of businesses say cash is king, but then they spend all their time looking at the profit and loss on the software and you kind of think maybe that's a step back from looking at the bank balance because people are starting to lose touch of what's really going on.

Speaker A:And, you know, so many businesses where they think, oh, I'm making a profit, but yeah, but you've got these loans and what about the tax?

Speaker A:And it's like, that's not money that you can necessarily say is mine to do what I please with.

Speaker A:So, yeah, yeah, I'm rambling a little bit, but then, you know, I followed up on the book with some various courses and such like, you know, I know there was.

Speaker A:I think Mike was doing the sort of, oh, if you want to find out a bit more, you know, the stuff and resources you can look at.

Speaker A:And I followed all of those and there was profit first professionals at the time, but it was in the U.S.

Speaker A:yep.

Speaker A:And I was put off the, you know, the time zone differences.

Speaker A:Guess we had a young, a couple of young kids at the time, so I probably would be up at the time, but that kind of put me off a little bit.

Speaker A:Also there's some other issues, you know, with different taxes and stuff like that.

Speaker A:So it is slightly different.

Speaker A:And then I just saw something pop up from you guys actually saying, oh, here's one for the uk.

Speaker A:And I thought, well, that's quite good.

Speaker A:And yeah, I remember actually speaking to you about it and said, well, I've got a few questions about Profit first and, you know, I'm not quite sure this isn't quite how I do it.

Speaker A:And, you know, what are your thoughts?

Speaker A:And yeah, I just liked your pragmatic view of.

Speaker A:Yeah, yeah, you know, it's like, how to put this?

Speaker A:With any system, you can always break the rules and sometimes that's good because it sort of like helped you make progress.

Speaker A:Sometimes ain't profit first is a bit dangerous because you.

Speaker A:If people don't know what they're doing, they break the wrong rules rather than the right rules.

Speaker A:So it's like, yeah, okay, if you're doing it that way, you're following the spirit of the book, but if you do this one, it's a waste of time.

Speaker B:Yeah, agreed.

Speaker B:Yeah, it's an interesting thing.

Speaker B:And I remember, I remember as soon as you said about the call and asking lots of questions, you did have lots of questions, which, by the way, was great because it demonstrated how much you'd been thinking about Profit first and how it could work for you and your business, but also for your clients.

Speaker B:And, and I think that the main answer to these questions are as long as you and your clients are becoming more profitable, getting clarity on, on their money and what's happening with it, and are able to build up and pay themselves more and reward themselves properly for the business, create a long term sustainable business, which profit first enables you to do business.

Speaker B:You can look after your team, you can look after your customers better and all your suppliers as well, if you want to, then that's okay, isn't it?

Speaker B:Then then you must be doing something right.

Speaker B:So if you're following the profit first principles and the behavioral aspects, but you're perhaps changing stuff in and around how it works, you know, that's okay because it's working for you and it's working for your clients.

Speaker B:And, and I like that approach that you have for it also.

Speaker B:I know the way that you work.

Speaker B:So when you, so you had a call with me and you decided to join, at that point you built up your own accountancy business, hadn't you?

Speaker B:Whereas before you'd had a driving instructor, business strategy, musician business, then you went into to work for accountancy businesses in the financial world, etc.

Speaker B:And you did your accountancy exams.

Speaker B:Then you started building that business on the side, didn't you, whilst you were still working for someone.

Speaker B:Have I got that right from memory?

Speaker A:Yeah, yeah, it was quite funny actually because, you know, sort of one of those victims of a restructure and thinking, all right, what's my next step?

Speaker A:And I thought, yeah, I quite like the idea of running a counsel for myself.

Speaker A:I had my ideas of how I'd like to do things and I still remember, you know, going to some networking things.

Speaker A:I got my first client and then the next day I got a job offer and it was a case.

Speaker A:I had another child on the way.

Speaker A:So you're like, oh, this is, this is tricky.

Speaker A:Well, it wasn't that tricky.

Speaker A:It's like, right, I'm going to go for the job.

Speaker A:But there's something about it.

Speaker A:There's.

Speaker A:I can still remember going for sort of interviews and sometimes you just make a decision.

Speaker A:Yeah.

Speaker A:And you think, shall I?

Speaker A:This was with another role, should I take that job or not?

Speaker A:And I thought, no, I want to make my own, run my own business.

Speaker A:So well, I mean, quite a few people probably relate to this.

Speaker A:While it might seem like a side hustle, it never was a side project.

Speaker A:It always was a serious business.

Speaker A:It was just, you know, squeezed into minimal bites of time.

Speaker A:And so yeah, I got, took the full job, full time job.

Speaker A:But you know, I looked after that one client and then that sort of became more clients and then gradually built the business up until the final moment where I had to go to my boss and say, you know, kind of hand him a notice which was, it was quite hard.

Speaker A:I still remember I felt so nervous mainly because I really like my boss and you know, he was brilliant.

Speaker A:But is this.

Speaker A:Yeah.

Speaker A:When you've not been looking and on my commute in, this is what I've been doing.

Speaker A:But he was brilliant and actually all credit to them, they turned around and said, well you know, don't resign yet, we'll have a little chat.

Speaker A:And then they came back and said we're willing to provide part time working.

Speaker A:So it allowed a nice nicely eased in route.

Speaker A:But I can't, I can't take any credit for that.

Speaker A:That was just pure luck.

Speaker A:And you know, I was just lucky to have good people around me who were supportive.

Speaker B:Yeah, yeah, that's, yeah.

Speaker B:But that's an amazing thing for them to do because they could have had the, the narrow minded view that oh, you're going, you're not really focused on what you're doing so we just let you go.

Speaker B:But actually they decided let's help you move gradually away.

Speaker B:And since I'm part time working around your business, which allowed you to stop working on the train, which I remember you telling me before, you did a lot of your work on the train on the commute to and from work and so I guess that helped you then set the structure for the business as it's developed into now.

Speaker B:And at what stage was it during this process that you then joined, joined us at profit first Vestures, you know, on a sort of time frame.

Speaker A:Oh golly, I'm trying to think.

Speaker A:So I'd been.

Speaker A:After that I was working from home.

Speaker A:I mean I'm now in an office because I prefer that segregation of home and work.

Speaker A:I think I had a, I had a, I'd taken on a few people who were working with me at that time.

Speaker A:I think it was just quite random because it was something about the.

Speaker A:Prof.

Speaker A:When I read Profit first it made sense to me and I kind of.

Speaker A:Some of the ideas had seeped in.

Speaker A:There's some bits I was kind of clear on, some bits I was thinking of kind of going slightly my, a different way and then I can't really remember how long I'd been going.

Speaker A:I probably read the book a good two or three years ago before I joined you guys.

Speaker A:And then, you know, I saw that it was in the uk, so there were calls to have, and then again having a chat with you and actually debating how best to implement these things.

Speaker A:And, you know, this is, this is what the book says, but I've gone and done this, you know, am I missing something?

Speaker A:And actually debating.

Speaker A:It was quite good and I quite like the idea of this.

Speaker A:I'd be on the book, it's just, you know, yeah, a few pages.

Speaker A:It's some great ideas in it, but I think it's implementing it and I mean, a good example is different for everyone.

Speaker A:But part of the profit verse training is, you know, you have to go through it all and I suppose when you're trying something, you have to go a bit psycho.

Speaker A:I mean, when I first started my practice, I, I changed my accounting software every sort of like two to three months, which is not recommended to anyone.

Speaker A:But if you are going to help people take on this software, it's good to have a feel for what it's like to live with it.

Speaker A:And same thing with profit first.

Speaker A:So there is the idea with my bank account.

Speaker A:I kept it really, really tight and I remember sort of, I realized when it was really working, when I was getting this, like the daily text message and I would panic, I knew there was enough money, I knew money was coming in, but somehow there's.

Speaker A:It gives you a real visceral feeling for what's happening with your business.

Speaker A:And I know Jason's mentioned the idea that it just makes you a better business owner.

Speaker A:I think it's almost like, you know, if you burn your hand, you don't have to be told, oh, this is what it'll do to your fingers or whatever you move your hands.

Speaker A:It's that sort of idea.

Speaker A:And you think, oh, there's not the money in there.

Speaker A:And I think by moving money out, it doesn't kid yourself.

Speaker A:You don't kid yourself you've got more money than you do because, you know, you've got the VAT money and everything else like that, it's just not there.

Speaker A:But cutting it right to the bone, it really does change things.

Speaker A:And I found, talking to clients, that for some of them, that's the amount of anxiety it would give them.

Speaker A:Yeah, yeah, fine for us to do it because, you know, we might as well learn that, you know, really sort of go for hardcore with it all.

Speaker A:But, yeah, it'd just be unfair or cruel or they'd be constantly worrying about, oh, is enough money in the bank for this direct debit.

Speaker A:And cause other issues.

Speaker A:And it was just working with people.

Speaker A:The idea, well, okay, let's, let's have a minimum in your bank.

Speaker A:It doesn't have to be zero and it can, you know, we know if it's got this much, you've got enough for the next couple of months in your current account.

Speaker A:It's a step in the right direction.

Speaker A:We know we've got enough money for your tax and we'll keep that.

Speaker A:And if it goes below that amount, you know, things are going the wrong way, but you don't have to panic.

Speaker A:And I kind of like that way of that flexibility of working out how's best to really help people with this.

Speaker B:Yeah, yeah.

Speaker B:And every client is different, aren't they?

Speaker B:They've got different thought processes around money.

Speaker B:They've got different targets they're trying to achieve.

Speaker B:So what I'm hearing from you is rather than create overwhelm of no, you've got to open all these accounts, you've got to do this money, you've got to do that.

Speaker B:You've actually tried to take the overwhelm away from them and do one step at a time, but also then create some buffers in the pots so that they've got peace of mind that this money is staying in there.

Speaker B:There's always going to be that there.

Speaker B:So if something unexpected or a build that's been forgotten about suddenly appears, the money's there to cover it.

Speaker A:Oh, I totally, totally.

Speaker A:I start off with.

Speaker A:And even on introductory calls, just have a separate bank account for your tax, leave it at that and then you can grow it.

Speaker A:Had one client that came up, they, they put a fun account in because they just didn't like the idea of taking the money out of the business.

Speaker A:I'm like, well, fine, but just how about that money you just put into another business account and if you don't need to touch it, you know, at the end of the year, I can say I told you so and then you can take it out.

Speaker A:But at least, at least you don't have that panic.

Speaker A:Because I think sometimes, I don't know, I think we can put too much pressure on ourselves to do this, that or whatever.

Speaker A:And sometimes it needs time to bed in.

Speaker A:And if it's kept comfortable and baby steps, I think people make better progress.

Speaker A:And if they just go mental, create millions of accounts and I think sometimes profit first.

Speaker A:I always found this a bit of challenge is people sometimes to go into it and they're not in the best of shapes already.

Speaker A:You know, it's almost like actually things are quite tight and there's a big tax bill that is looming that they haven't got the money for.

Speaker A:So I think sometimes you have to kind of break it down.

Speaker A:Oh, this is what we're going to do.

Speaker A:And even if you do have to go down the, you know, the, the uncomfortable routes of maybe breaking some of the rules in order to get to where you want to be, you know, maybe there is a time to pay agreement with HMRC or something else, but you kind of factor it in and say, okay, it's not a problem, but this is how we're gonna get this to work and get things into a better shape.

Speaker A:And it might take a year, it might take two years, but then you're there.

Speaker B:Yeah, and I think that's, that's the clever part with profit first, isn't it?

Speaker B:You, you're, you're looking at the long term.

Speaker B:We're always looking ahead and we're looking long term.

Speaker B:We're not just looking in next three months.

Speaker B:So if, like you say, if the tax bill's there, it can't be paid and you've got to spread it out over a number of months with an agreement with hmrc, so be it.

Speaker B:If that's what has to be done, that's what has to be done.

Speaker B:If, if you have to take a loan out to cover something, if it has to be done, it has to be done.

Speaker B:But there's a way of managing that moving forward and making sure that the cash is there first and foremost to pay what you've committed to, but also to make sure that it's going in the right areas as well for the business to be profitable or to move towards profitability if they're in a loss making situation.

Speaker A:Now, I think there's a lot of the tax death spiral is a classic one of that, isn't it?

Speaker A:Someone gets in January, oh my God, I've got a huge tax bill.

Speaker A:So then they go crazy to kind of make more sales.

Speaker A:But all that's happening is yes, they're creating more sales, but then there's a tax on those sales, but they're using that tax to pay the prior, you know, the prior bill.

Speaker A:And it's just, I think unless you sit back and go, well, what's actually happening?

Speaker A:How is the money flowing through?

Speaker A:You can potentially create yourself more of a problem.

Speaker B:Yeah, yeah.

Speaker B:So, so is this a theme that you find that your clients do, you do, when you work with clients for profit first, is it mainly one step at a time?

Speaker B:Let's Solve this problem first.

Speaker B:Let's move this first.

Speaker A:Yeah, I think the challenge is working out what the first problem is to solve.

Speaker A:Yeah, I, like someone, put quite a good analogy.

Speaker A:Is this more of a golf coach is saying that, you know, it's not a matter of seeing someone and saying, well, this is what you do and this is what Tiger woods does and just changing everything.

Speaker A:It's almost that little tweak bit by bit.

Speaker A:You know, hold your shoulder slightly different, hold the club slightly different, and by each of these tweaks, it adds up to something that actually makes things work.

Speaker A:Because I guess people have just got enough things to worry about and, you know, they're running their business.

Speaker A:And if you can make slight tweaks to make things a little bit easy for them and then they get the, you know, see the advantage of it all.

Speaker A:It's more of a habit, isn't it?

Speaker A:It's not.

Speaker A:I mean, I've seen you posting about, you know, sort of the monthly profit withdrawal or, you know, and that's.

Speaker A:That's fine, but it's almost getting that habit of getting that rhythm as well.

Speaker A:This is what I do and just letting it just.

Speaker A:Just flow through naturally rather than being a big.

Speaker A:Right.

Speaker A:And I've seen it with some people when they try to implement it themselves, sometimes they just go a bit hardcore open millions of accounts, possibly more than they actually need anyway, have a look at loads of percentages.

Speaker A:And I guess the danger of doing too much at first is you can lose sight of where the real keys are.

Speaker A:And it's.

Speaker A:It's very fragile because it only needs one bad month.

Speaker A:And then suddenly like, oh, my God, you know, I put all these percentages everywhere else, but now I've not got the money to pay this bill here.

Speaker A:What's going on?

Speaker A:And it's like, well, yeah, that's not a big problem, but you need to kind of have something make the system a bit more robust, you know, maybe.

Speaker A:Okay, I know I don't need to worry about tax, and I dare say there are people where they have a bad month.

Speaker A:I think we've been guilty of, say, okay, there's money in the tax account.

Speaker A:Things are a bit tight.

Speaker A:We'll take a little bit out, but we know we need to make that up over the next few months.

Speaker A:So it's almost your loan borrowing from the tax account.

Speaker A:I probably shouldn't say that I'll get struck down, but I think it does help because it's better to do that and take a proper loan out or not pay a supplier that's going to cause problems.

Speaker A:And it's taking that approach and they're slowly moving forward.

Speaker A:And then, okay, here's your profit account.

Speaker A:You're building that up and then what do you want to do?

Speaker A:Profit, yes.

Speaker A:It could be a buffer for bad times.

Speaker A:It can be for business development, things that you're planning, or it could be for a bonus.

Speaker A:But then you start having a bit more of a sensible decision of, okay, I have this money that's more discretionary and how best to use it.

Speaker A:But you know, to get there from day one.

Speaker A:Because I mean, the book, it does talk about, you know, even if it's like 1% goes in there, it gets that habit.

Speaker A:But yeah, 1% isn't necessarily going to do anything after one month or two months, but it's slowly, you know, greasing the wheel.

Speaker A:So you get there, don't you?

Speaker B:The 1% analogy is, is to prove the system works.

Speaker B:Is, is to say if you, if you can't survive by taking 1% out of your whole revenue come into your business, then you've got a very serious problem with your business.

Speaker B:So you should be able to put 1% of your income into a profit pot and just watch it gradually increase.

Speaker B:And it will take time, of course.

Speaker B:It's not going to set the world on fire, but it's something and it's a starting point, isn't it?

Speaker B:And, and I think, yeah, starting somewhere is better than not starting.

Speaker B:But I love, I love what you said.

Speaker B:You know, the advantage of working with a profit first professional is in everything you just talked about.

Speaker B:Because the book is, is a fantastic book, as we all know, we're all fans of it, but it's a book and we live in the real world.

Speaker B:And in reality, things go wrong, things happen with money that we aren't expecting.

Speaker B:You know, customers suddenly don't pay or, yeah, there's a bill we've forgotten about, an annual insurance bill that we've just completely forgotten about.

Speaker B:But being able to go to.

Speaker B:So if I was your client, I was able to come to you and say, look, I'm going to have to take some of this money out of the tax account.

Speaker B:I've got to pay this bill.

Speaker B:My business can operate without paying this bill.

Speaker B:It's really important to me.

Speaker B:You can have that conversation.

Speaker B:But they've got the clarity on what's happening.

Speaker B:And then like you said, you can then start to perhaps tweak the percentages.

Speaker B:So a little bit more money of the revenue that's Coming in now is going back into that tax pot so that you can build it up and get to get back to where it was and hit the target that you need to hit for the end of year, knowing what their future tax bill is going to be.

Speaker B:For me, that's the fantastic advantage of business owners working with property first professionals because we can guide them through that process.

Speaker B:Whereas if they didn't have a profit first professional to go to, more than likely they would stop making allocations the next week as well.

Speaker B:So like you say, the rhythm and the habits are really important for us to keep moving.

Speaker A:I think you touched a nice thing.

Speaker A:You know, I was talking before about the whole simplified business model.

Speaker A:I mean, if you do sort of say, here's the money that comes in, here are my expenses and I'll take a bit out for tax and I'm going to take a bit of profit.

Speaker A:And if you can't do that, that's a sure far away that your business model isn't working.

Speaker A:Because maybe, and I think unfortunately for some businesses it is the case that they aren't making profit and it's, or, you know, it's so close to the bone that they can't.

Speaker A:Well, I suppose it's more with dividends without getting into the boring technical side of it all, but it is almost the fact that they're using the tax money to live and then at the end of the year they're like, oh, I'll just raise a dividend to cover it.

Speaker A:And you're like, no, you can't.

Speaker A:There is no profit.

Speaker A:And that's really, really unfortunate.

Speaker A:But at least this kind of, I don't know, it makes it tangible, as in this is the money in the bank accounts and that's how your business is actually running.

Speaker A:And I think people can get that.

Speaker A:Yeah, you know, it's very clear what's going on and whether the pots are going up or down.

Speaker A:And that's all you need to worry about, really.

Speaker A:But then if it isn't working, then you can go into, you know, the nitty gritty of looking at the expenses, looking at the income, working how best to leverage your time to really make a difference to the business.

Speaker B:Yeah, without doubt.

Speaker B:And the thing to highlight as well is profit first isn't just about stripping expenses out and reducing costs and stuff.

Speaker B:We encourage our members and our clients to look at their expenses, don't we, in a way, to see what's the return on this.

Speaker B:Why am I paying for this?

Speaker B:What am I getting for it?

Speaker B:Is it Giving me value for money and am I getting a return on that investment?

Speaker B:Therefore should I continue making that payment?

Speaker B:You know, does it protect me if it's an insurance policy etc.

Speaker B:And, and so being able to understand what's going into operating expenses is key with Profit first but also what's coming into the business and where's the most profitable income stream etc of this particular client, you know, how can we help them increase their margins?

Speaker B:So you know, it's an all round accountancy service that everybody should be doing.

Speaker B:But Profit first enables you to have clarity on that by looking at the money and giving you that financial kind of aspect to it, doesn't it?

Speaker A:I think even there with another point because it uses bank and actual cash moving around and I like the way of putting provisions in separate bank accounts because it kind of forces it to be more of a well reflect what's happening in the P L there is that weakness of the P L and particularly now with you know, bounce back loans still, still being paid, sometimes bigger loans on top of that.

Speaker A:Yeah, there are mountainous businesses where yes, they're profitable but actually the loans are very much expensive, you know, quite a big expense.

Speaker A:And I find sometimes people look at the expenses and P L start wondering about oh I want to shrink this cost here and this service there.

Speaker A:And I think these are, these are a fraction of what you're paying your loans.

Speaker A:So actually get the loan out the way first rather than making your life difficult by cutting services.

Speaker A:You actually need to support your income.

Speaker A:But it's, it's good to have those conversations and I think, yeah, I think some, I wouldn't think about this sometimes where the software can be a step back if people don't understand it because they think oh yeah, that's, that's how my business is doing.

Speaker A:I'm making profit, I'm good, I can take out all this money and it's like, well no, what about, you know, look at your balance sheet, look at your cash flow, look at all these things.

Speaker A:And I kind of like the way that a system that is more cash based does force people to think a little bit more about.

Speaker A:No, this is the flow of money through your business because you can have a huge profit but if you've got one client that is giving you on paper a huge amount of income each month but actually isn't paying you.

Speaker A:Yeah, that's actually a bit of a problem.

Speaker B:Yeah, massive problem.

Speaker B:But yeah, like you say, looking at the pots, looking at the, the, the profit first accounts growing, looking at the Money growing in, in the right areas.

Speaker B:It just gives you peace of mind and gives you clarity, doesn't it, on how you can move forward with your business.

Speaker B:And it also highlights where there's an issue come in as well, you know.

Speaker B:So if, you know, like you say, there's not much to allocate this week, why is that?

Speaker B:Someone's not paid you and, you know, so, okay, so let's get on to that quite quickly and solve that problem so that the money's coming in, because I need to make sure that money is going into the owner's pay so I can pay myself at the end of the month properly.

Speaker B:I need that money going in my tax pot because my tax bill is going to be juicy.

Speaker B:All these things are in your head, but being able to see it and being able to highlight the problems quickly are really important, aren't they?

Speaker B:So, so, John, tell me how, how are your clients reacting?

Speaker B:So, so the clients you're working with, with profit first, how are they reacting and then what are they saying about profit first?

Speaker B:How's it affecting them?

Speaker A:The simple answer, I'm trying to sound too flippant is they don't know.

Speaker A:I see it as being a kind of a tool that I kind of use in the background.

Speaker A:So for most of my clients, you know, even at support, I try.

Speaker A:And for most of them, they get at least an email once a quarter with, you know, a few key figures and highlighting any potential issues.

Speaker A:And I will kind of use profit first to analyze how the business is doing, to say, oh, you know, this is how much money we should have side for tax and whether there's a short.

Speaker A:So I'll do that in the background.

Speaker A:So I see it as more of a tool for me in a way to kind of guide them through it.

Speaker A:I, I did experiment with the idea of saying, or, you know, profit first.

Speaker A:And some people do like the idea of profit first, but I don't think anyone really wants someone just to go through, right, we'll just do profit first.

Speaker A:Or I didn't have too much success, you know, sort of presenting it that way.

Speaker A:But it's almost like once you start seeing it from the client perspective and you start seeing this, how we can help people, this is a simple way of doing it.

Speaker A:Why wouldn't you just kind of try and bake it into everything?

Speaker A:Yeah, and that's what we do, you know, behind the scenes.

Speaker A:We do have a sort of like, we review spreadsheet.

Speaker A:The client doesn't need to see that.

Speaker A:And we can go through that.

Speaker A:And then we can just tell them this is almost what should be in each of these bank accounts.

Speaker A:And then that can spark the conversation.

Speaker A:And if there is a problem, we can help them or we can let them know we see a problem coming down the line.

Speaker A:So it's more of that.

Speaker A:I don't know that's what you're expecting, but I don't know.

Speaker A:I just see it's another skill or another.

Speaker A:A tool you learn, isn't it?

Speaker A:And then you just bring it to party.

Speaker A:Same with any other skill you learn.

Speaker A:You don't necessarily say, oh, yes, I did them some advanced thing in VAT planning.

Speaker A:You just do it.

Speaker B:Yeah, I think.

Speaker B:No, I think it's perfectly reasonable what you're saying.

Speaker A:And.

Speaker B:And it.

Speaker B:Yeah, it is.

Speaker B:People get a little bit confused and they think that profit versus a product that you have to provide or service you have to provide, and then you have to sell it, you know, and how do you sell it?

Speaker B:And then becomes this almighty pressure on your shoulders that you've got to sell something, otherwise why would you be doing profit first, etc.

Speaker B:So I think the fact that you just bake into everything you do, it actually sits quite close to what I did when I had my accountancy business and I had three separate distinct packages.

Speaker B:And they all had an element of profit first, whether they wanted it or not, whether they understood what it was or not, and whether they actually realized that the people on the lower level didn't really realize they had it, but they were given information to be able to act on if they wanted to.

Speaker B:So it sounds like you're just adopting the principles for all your clients.

Speaker B:And why wouldn't you?

Speaker B:Because at the end of the day, they're your customers.

Speaker B:Your job's to serve them and look after them.

Speaker B:So you're incorporating it in.

Speaker B:They might not be aware of it, but they are seeing success by having the extra pots and having the money building up in the background into those.

Speaker B:Into those areas that you want them to have it.

Speaker A:Yeah, totally.

Speaker A:I mean, I do a coaching program I've just put together and I suppose one part of it is probably very much cash allocation.

Speaker A:So that's another way of saying profit first.

Speaker A:But yeah, that's not to say when I look at a simple business model that some of the idea of it is inspired a bit by profit first, of where the money's going.

Speaker A:You know, expense analysis, all these bits and bobs.

Speaker A:It's just.

Speaker A:It runs a bit through.

Speaker A:It's like.

Speaker A:I think it's through business, you like, you learn from seeing what happens with.

Speaker A:It's quite interesting accountancy because you do deal with so many different businesses and actually seeing them know, behind the scenes wars and all, and you learn from that and you see what works, what doesn't work and you pick up various tools and I mean, being part of Profit first professionals with you guys, you know, having calls where you get other people talking about this is what worked, this is what doesn't.

Speaker A:I know sometimes when people opposed the questions like, you know, should you use a loan to kind of kick start profit first or all these sorts of ideas and you kind of get in a feel, oh, that works or that'll work for that person.

Speaker A:But for that person, that's going to be sure fire disaster.

Speaker A:Because it's not going to be, you know, they're just the wrong sort of person.

Speaker A:They're going to implement.

Speaker A:That sounds terrible, but, you know.

Speaker A:And they're going to implement it in the wrong way.

Speaker A:Yeah, it's going to be a crutch rather than a support.

Speaker A:I'm really not doing too well with metaphors at the moment, but do you know what I mean?

Speaker A:There's sometimes there's something, you know, that will help them do the same for someone else and you know that they'll probably rely on it a bit too much and then next week they'll be wanting to do more of the same and you're like, no, no, no, no, no.

Speaker A:This was a quick fix just to get you over the next month.

Speaker A:Yeah.

Speaker A:So, you know, I think that's, it's been, it's definitely a really handy way of coming back to the beginning of the call, I think kind of takes you back to looking it through a business owner's eyes.

Speaker A:And it's quite nice blending all these different tools and ways of looking at how a business's finances work and then presenting to someone in the way that makes the most sense to them and actually helps them the most.

Speaker B:Yeah, I, I agree.

Speaker B:Because how many business owners that are specialists in what their business is, they're not accountants, they're not bookkeepers, how many of them really understand the balance sheet, in all fairness, you know, it's asking a lot, isn't it, to put a balance sheet in front of somebody, expecting them to understand what we're talking about.

Speaker B:So being able to operate a business through bank accounts, you know, and to see money building up in different areas and cover off different aspects, it just gives clarity, doesn't it, for people?

Speaker B:And they just want simplicity.

Speaker B:I find you know, the more simple we can make it for people, the better and better opportunity they've got to run their business.

Speaker B:Because nobody, nobody teaches you how to, how to be a business owner, do they?

Speaker B:You know, where, where do you learn that?

Speaker A:Other than no one tells you about the tax system either.

Speaker A:So it's like a whole bigger question around that, isn't it?

Speaker A:Taxpayers go, oh, did I have to do a tax return?

Speaker A:You're like, yeah, yeah, yeah.

Speaker A:You missed the memo as well, did you?

Speaker B:Yeah, always.

Speaker B:Always.

Speaker B:Yeah.

Speaker B:So yeah, brilliant John, thank you very much.

Speaker B:So just tell me, just tell me briefly as well, what, what's the impact of, of profit first in your own business and being a profit first professional, how's that helped you with your business?

Speaker A:I suppose benefits across everywhere.

Speaker A:I think it's that idea of, yeah.

Speaker A:When it gives you a clearer view of whether things are going well or not.

Speaker A:It's quite nice sitting back knowing that yes, I've got a bank account for you know, say the payroll and that's got a month in it, you know, so it's like everyone's getting paid it.

Speaker A:As I say it gives me, keeps me more in tune with what's happening to the business whether I want to or not, which is good.

Speaker A:I also found it's quite interesting suppose, you know, working with you guys and actually having other people rip through my accounts with me because it's very funny because as an accountant you don't have another accountant that's really helping you.

Speaker A:So you just are used to doing it.

Speaker A:So you're not quite used to that whole thing of almost having to explain what's happening with the finances of your business to other people who really understand what's going on when they look at your being up your P L and your balance sheet and go what was going on here?

Speaker A:So that's quite fun because it's, it, it just gives you that insight of what it feels like for your clients as well, which I find is quite, quite cool.

Speaker B:Yeah, yeah.

Speaker B:We always enjoy the calls we have with you and it is interesting to look at forecasts and look at different areas of the financial aspects of our members business and trying to help them, especially from the profit, you know, sort of assessment scenario which is what obviously we always want to look at and we almost look, want to look at, you know, where are you at now?

Speaker B:Where were you?

Speaker B:And if you're going to go take your business to this level, what would a profit assessment look like at that point?

Speaker B:Which is something I think I like to ask that question and, and talk about, you know, because everything to do a profit first is looking forward, isn't it?

Speaker B:It's always looking into the future and I think it's relevant for members but also for clients.

Speaker B:And no one can change what's happened in the past, but we can alter the future.

Speaker B:And I, I believe that's what Profit first and Profit First Specials are doing in their own businesses and for their clients business.

Speaker B:So, so thank you, John.

Speaker B:I really appreciate, really appreciate your time.

Speaker B:Appreciate you answering my questions and so what, what type of businesses do you work with?

Speaker B:You know, if someone wants to work with you, you know, and they want to get in contact with you, what, what should they do?

Speaker A:I work with quite a range of businesses.

Speaker A:A lot of them are service based businesses, you know, mainly limited companies, VAT registered.

Speaker A:Yep.

Speaker A:They can get in touch to us through the website@bedfordaccounting.co.uk or contact me directly on LinkedIn.

Speaker A:There's a nice little link there.

Speaker A:Or email me at johnherfootaccounting.co.uk and I'd love to hear from you.

Speaker B:Brilliant.

Speaker B:Thank you ever so much, John.

Speaker B:I've really enjoyed our conversation.

Speaker B:It's great to, to hear you talk about Profit first and thank you for everything you do for our community and also for your clients in respect of helping them be more profitable, more successful in their businesses.

Speaker B:So thank you for joining me today.

Speaker A:All right, take care.

Speaker A:K.

Speaker B:Thank you for joining us on our podcast today.

Speaker B:Profit first beyond.

Speaker B:The book was brought to you by the Profit First Professionals UK and Ireland team.

Speaker B:If you'd like to find out more about Profit first or becoming a Profit First Professional, head to our website profitfirstuk.co.uk.