The Journey of a Profit First Professional: Growth and Transformation

The salient point of this podcast episode is the profound impact that the Profit First methodology has had on the business practices of Stephen Edwards, a seasoned accountant and Profit First Professional. During our conversation, Stephen articulates the transformative journey he has undertaken in embracing this system, which not only enhanced his business's profitability but also reshaped his approach to client interactions. He recounts the significance of mindset shifts necessary for accountants to transition from traditional roles to that of business advisors, fostering deeper connections with their clients. Throughout the episode, we explore specific strategies that Stephen employed to implement Profit First effectively, including the establishment of targeted allocation percentages and the importance of gradual habit formation. Ultimately, this discourse serves as an enlightening testament to how adopting innovative financial frameworks can catalyze substantial growth and success for both accountants and their clients alike.

This episode presents a rich dialogue with Stephen Edwards, a prominent figure in the realm of Profit First Professionals, who shares his insightful journey as an accountant and entrepreneur. The conversation begins with Stephen's introduction, where he reflects on his extensive experience in accounting, spanning over two decades, and his evolution into a Profit First Professional. His narrative highlights a significant mindset shift that he experienced, moving from a traditional accounting perspective to one that embraces the principles of Profit First, which focus on prioritizing profit and fostering financial clarity for business owners.

As the discussion unfolds, Stephen elaborates on the key strategies and frameworks that he employs to help his clients achieve financial success. He emphasizes the importance of understanding one’s financial landscape and adapting Profit First principles to meet the unique needs of each business. This conversation is not merely theoretical; it is rooted in real-world applications and success stories, illustrating how the implementation of Profit First can lead to substantial improvements in a business's profitability and operational efficiency. Stephen shares compelling anecdotes of clients who have experienced transformative changes in their financial management practices, reinforcing the efficacy of the Profit First system. Through this engaging dialogue, the podcast effectively communicates the value of embracing innovative financial strategies and the profound impact they can have on both accountants and their clients.

Takeaways:

- The importance of adopting a business owner mindset rather than a traditional accountant perspective is paramount for success.

- Profit First provides a systematic approach that significantly enhances financial clarity and profitability for business owners.

- The journey towards implementing Profit First should be gradual, allowing clients to adapt and establish new financial habits effectively.

- Emphasizing continuous improvement, the rebranding to Grow Profit First Accountants reflects a commitment to evolving alongside clients.

- A notable success story illustrates how a client transformed his business by embracing Profit First principles, leading to increased revenue and reduced costs.

- The key takeaway is that implementing Profit First is not merely a cost-cutting measure, but rather a comprehensive strategy for sustained financial health and growth.

Links referenced in this episode:

Companies mentioned in this episode:

- Profit First

- Profit First Professionals UK and Ireland

- Cheltenham Tax Accountants

- Grow Profit First Accountants

Transcript

Foreign.

Speaker B:Welcome to Profit first beyond the Book, a podcast that takes you beyond the book with Profit first brought to you by Tim Duncan and the rest of the Profit First Professionals UK and Ireland team.

Speaker B:Hey Duncan, how are you?

Speaker A:Hi Tim, how you doing?

Speaker B:Really good, mate, really good.

Speaker B:So who have we got on our podcast today?

Speaker A:I'm delighted.

Speaker A:Today our very first guest is Stephen Edwards, one of our longest standing Profit First Professionals.

Speaker A:And here he is.

Speaker C:I'm very well, thank you and really excited to be here.

Speaker B:Good, good.

Speaker B:So Steve, tell us a little bit about yourself, who you are and about your business, please.

Speaker C:Yeah, okay, so I, I've been an accountant for probably 20 years now.

Speaker C:Quite scary.

Speaker C:20 years.

Speaker C:Been running my own business for just over 10 years.

Speaker C:I've been a Profit First Professional for the last few years and we're, we're based in Gloucestershire, in Cheltenham.

Speaker C:We've got around a dozen team members and we like to work with entrepreneurial business owners that are looking to grow their business.

Speaker C:Fantastic.

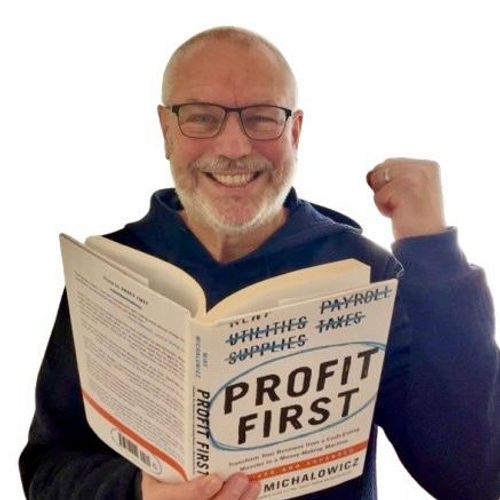

Speaker A:And Steve, you're also a published author, aren't you?

Speaker A:So why don't you tell us a bit about your latest achievement, your book.

Speaker C:I am, yes.

Speaker C:So my book's called how to Build a Business that Runs without you and it was released last year and really it was the kind of 10 year journey of building my own business and it's a little bit toning cheek because I think business is always a work in progress.

Speaker C:You know, I'm still a work in progress in my own business but looking backwards, kind of connecting the dots.

Speaker C:This is my system.

Speaker C:If I was to do it again, how would I build a business to, you know, repeat what I've done without making the mistakes or, or making less mistakes really.

Speaker C:And, and really the book's about firstly I call it the Busy Fall System.

Speaker C:So it's kind of what not to do in business.

Speaker C:And, and then I introduce my, my own 10 step system that's worked for me.

Speaker A:Fantastic.

Speaker A:I think that the books, it really represents you because you're, you know, I've worked with you for some time in the Profit first membership, you know, you and I in the Mastermind together and you were always so giving and supportive of the, the other members and, and the book really reflects your personality and I recommend it to everybody.

Speaker A:So can you, can you tell me as part of your Profit first journey, what was the, what was the biggest mindset shift that you had to take as part of that journey?

Speaker C:Yeah, so I, I think, and you know, I think it's the journey we go on as a business owner as well, that we, we need to start thinking not like a normal accountant.

Speaker C:We need to firstly, we need to start thinking like a business owner.

Speaker C:I think if you're kind of stuck thinking like a traditional accountant, then you might not be open minded to what Profit first is, is about.

Speaker C:So for me I was open minded because I, you know, I was into self development, I was into business development and I just kind of realized that just being a normal accountant wasn't enough.

Speaker C:And I felt like being in different business groups, masterminds, workshops.

Speaker C:Every time I introduced myself and said I'm an accountant, it just felt like there was something missing.

Speaker C:And Profit first for me was it become a way to stand out from the crowd.

Speaker C:But, but first and foremost, the book resonated with me as a business owner.

Speaker C:So I connected with the book as a business owner.

Speaker C:I didn't read it as an accountant, I read it as a business owner.

Speaker C:And then it become a vehicle to help other people essentially to help our clients.

Speaker A:Yeah, very similar experience.

Speaker A:Steve, you know, as accountants we're, we're comfortable with accounting terminology, but entrepreneurs rely on cash.

Speaker A:Right.

Speaker A:And I can see how my customers could really use, use the methods in it.

Speaker A:And it sounds like you had a similar, similar kind of epiphany.

Speaker A:And how was, how has been a, a Profit First Professional or a PFP as we like to call ourselves.

Speaker A:Has that helped you to grow your own business, Your own business?

Speaker A:And if so, how?

Speaker C:Yeah, it, it has.

Speaker C:You know, me and Tim have talked previously about this.

Speaker C:When I look backwards, I can put quite a, a big percentage of our growth to Profit First.

Speaker C:And to be honest, I, I look back in the last few years and I wonder where we would be without Profit first because it's become so much of what we do, so much a big part of our messaging and, and how we support our clients.

Speaker C:So it's had a huge impact and, and it's been, it's been a learning curve.

Speaker C:So at the beginning there's all the kind of question marks and uncertainty around how do we roll this out, how do we introduce it to the client base and the, the, you know, the training that the, you know, the Profit First University was really helpful in terms of taking one step at a time, you know, focusing on a handful of our clients.

Speaker C:And then it just become, it just become really natural and it's kind of just the way we, we do things now and it's just embedded into everything we do.

Speaker A:And the, the Profit first book is a series of principles rather than, rather than A how to manual, if you like.

Speaker A:You know, I've looked at your website.

Speaker A:I've read, I've read your book.

Speaker A:I understand a bit about how you, how you weave profit first into your own particular brand of helping your customers.

Speaker A:But what, why don't you tell us how, how have you customized profit first to make it, make it like Stephen Edwards ip?

Speaker C:Yeah, I think, you know, we, let's give credit to the system because it's a fantastic system that Mike's created.

Speaker C:But it's like anything, it's the whole 80, 20 principle, Pareto principle is that you kind of get the core concept fairly quickly and I think anyone reads in the book gets the core concept fairly quickly.

Speaker C:And, and, and then, you know, the, the, the kind of, the, the nuance comes from how you apply it with how you are as a business owner, how you are as a firm of accountants.

Speaker C:So for me, the foundation was profit first, but what it enabled me to do was just have a lot better conversations with our clients.

Speaker C:So I kind of felt like I transitioned, I transitioned and it was me initially announced the rest of the team, we transitioned into kind of business coaches, it felt like, and we're just having better conversations with our clients.

Speaker C:And, and really I think you've got to bring yourself to the table.

Speaker C:And I say this to my team as well.

Speaker C:A profit first meeting might be 30 profit first, then it's 70.

Speaker C:You, it's 70% who you are as a person, your experience, how you run your business.

Speaker C:And we've kind of really embraced, embraced that way of working with the team and the clients.

Speaker A:I love that and that, and that authenticity.

Speaker A:I think it's so important for your customers to buy you, to buy your firm and for you to really better help them.

Speaker A:You can't take someone else's IP and reapply.

Speaker A:It's got to be, it's got to have your own twist on it, which obviously profit first works beautifully for, for that and for you personally, Steve, how have you, has this helped your business make more money?

Speaker A:Is that, has that a difference for you personally?

Speaker A:Talk to me about that.

Speaker C:Yeah, so I think you, you know, you need to kind of walk the talk, don't really?

Speaker C:Don't you?

Speaker C:And that's why we're so, so passionate about profit first.

Speaker C:As it's worked in my business, it's worked in our own business.

Speaker C:So within probably two years we saw a 70 increase in our own profit.

Speaker C:So you know, that was, that, that, that was, that's life changing for a lot of people.

Speaker C:And And I know accountants are good with numbers, we're trained to be good with numbers.

Speaker C:But not all accountants are really good business owners.

Speaker C:And it's a bit like that.

Speaker C:The builder who's been doing other people's extensions, building their walls in the day, the last thing he wants to do is come home and build his own, do stuff in his own house, you know, do diy, you know, build his own extension.

Speaker C:And as accountants, it's a little bit like that, that there's maybe things that we don't put as much focus on in our own businesses.

Speaker C:And when Profit first come along, it helped me actually get more clarity in my own finances.

Speaker C:And I'm not ashamed to say that I'm a charter certified accountant, I've got 20 years experience.

Speaker C:But profit first gave me more clarity in my own business.

Speaker C:And that was the, that was the starting point for everything else.

Speaker B:I, I think, Stephen, that's, that's the key part of being a Profit First Professional, actually living and breathing Profit first in your own business and receiving that, you know, understanding the impact that it has so that you can then share that with your clients.

Speaker B:Can I just ask, how do you feel when you first started, how did you feel when you certified as a Profit first professional?

Speaker B:And then you started to talk to your clients about Profit first?

Speaker B:And how did that reflect in the advisory that you offered?

Speaker B:Because you mentioned just now about 70% being you.

Speaker B:And it's really interesting, I'd love to explore that a little bit more because we do find people find it quite hard to understand what advisory services are.

Speaker C:Yeah, yeah.

Speaker C:So, you know, for me, the whole kind of entry point into advisory, a lot of people, it's still a bit of a buzzword, isn't it, around the industry in terms of what does advisory mean?

Speaker C:I just think it means being more than a box ticker for your clients, doing more than the minimum.

Speaker C:And that's how we talk about it.

Speaker C:And it's basically listening, asking better questions.

Speaker C:And this really just facilitated.

Speaker C:It just gave us the, you know, the framework to have these better questions and you get to know your clients more.

Speaker C:You know, they pay you more, you provide a better service, they get better benefits.

Speaker C:So you're kind of growing together really.

Speaker C:And, and advisory really starts with investing the time to understand your clients needs and to really kind of get under the, the bonnet with their business and.

Speaker C:And yeah, Profit first has really been the gateway for us to do that.

Speaker B:Absolutely.

Speaker B:I agree.

Speaker B:I think Profit first gives you the opening conversation all the time, doesn't it?

Speaker B:And Then everything develops from there on in.

Speaker B:So that's really interesting.

Speaker B:Thanks for answering that.

Speaker B:And what, what would you say is the number one mistake business owners make with their finances?

Speaker B:Get profit first helps fix.

Speaker C:I, I'd say they, they feel it's more of a mindset that it serves, I think, for them.

Speaker C:So it's, it's.

Speaker C:The mistake is burying your head in the sand, but that comes.

Speaker C:The deeper level, is the mindset.

Speaker C:So they, they shy away from the numbers and they feel, deep down, I think they feel a little bit embarrassed that they don't understand their numbers properly.

Speaker C:And you guys have probably seen it where a client, a business owner says that I'm not an accountant.

Speaker C:I'm not very good with numbers.

Speaker C:This is not my thing.

Speaker C:This is what I do.

Speaker C:I do X, Y and Z and, and I stop them there and I say, no, you, you know, don't feel.

Speaker C:Embrace the fact that you don't know your numbers.

Speaker C:And you know, we want to work with you to help you understand your numbers.

Speaker C:And Profit first is a way of helping people understand their numbers.

Speaker C:And, and they understand it in a language that makes sense to them, which is money in the bank, essentially.

Speaker C:You know that, that, that expression that Mike talks about, I think he talks about in the book, when at the end of the year you go and see your accountant, they tell you how much profit you've made, and then the business owner reacts and says, where's the money gone?

Speaker C:Because I haven't seen the money.

Speaker C:And every time I share that story of our clients, it resonates with them.

Speaker C:And I think profit first just kind of crosses that, helps that bridge to, to help them understand that their finances.

Speaker B:Yeah, I like that.

Speaker B:And, and so helping them have clarity and understanding on their numbers and their finances and being able to look at their bank accounts.

Speaker B:Obviously we know the normal profit first pots is that.

Speaker B:Have you, have you used different types of pots for some different clients over your experiences that you could share with us?

Speaker C:Please.

Speaker C:Yeah, so my, my approach is, is, is initially to kind of take one step at a time.

Speaker C:You know, it's a bit like when I wrote my own book, if you can break it down to chapter and section.

Speaker C:So with clients, I, you know, we, I start with the core kind of, you know, 5 bank account, really start with the core accounts they talk about in the book.

Speaker C:And, and, and then we kind of add on to that.

Speaker C:So I'm trying to, I'm trying to build a habit change.

Speaker C:You know, it's a bit like going to the gym or doing a crash diet.

Speaker C:We want something that's going to stick.

Speaker C:So for me personally we're doing steps that, that they can stick to.

Speaker C:So I want to remove any friction in the, in the first few months.

Speaker C:So we make it as easy as possible.

Speaker C:So we start with the kind of minimum accounts in many ways, but once they get it, we can add as many accounts as they want.

Speaker C:And I think they get quite excited by adding different accounts.

Speaker C:And you know, obviously in the community the expression is if in doubt, open an account.

Speaker B:So, so, exactly.

Speaker B:And, and when you're working with people, obviously people have read the book and they might come, they might find you because I mean you've rebranded your company, haven't you?

Speaker B:Which we haven't talked about yet.

Speaker B:Maybe we should touch on that in a second.

Speaker B:They've read the book and a lot of people will think to themselves, okay, these are the target allocation percentages for my size business.

Speaker B:Therefore this is what I need to start working towards.

Speaker B:How do you move people to the target allocation percentages or how do you set those targets up for your clients?

Speaker C:Yeah, so that's a good question because it's a really important distinction with how we work with, with our clients.

Speaker C:So you know, again, I use the gym analogy quite a lot.

Speaker C:So if someone, I make up a figure, someone weighs 18 stone and they want to get down to 12 stone, it's really demotivating to focus on that 12 stone in the first few months because it's so far away.

Speaker C:So what I do is I, we, we show them the targets from, you know, the, the, the book and the, the kind of main HQ figures that we're aiming for.

Speaker C:And because I want an emotional response from our clients, I want them to see these numbers and I want them to think, wow, what does life look like with those sort of figures in my bank account?

Speaker C:Or what would I do?

Speaker C:And I might take a couple of minutes to say, what would you do with that sort of money with the main long term figures?

Speaker C:And then I stop them and say, however, we definitely want to get there 100%.

Speaker C:And you might be thinking that's impossible.

Speaker C:And I, a lot of people think this is challenging.

Speaker C:I understand what you're feeling.

Speaker C:You know your business better than we do.

Speaker C:How can we get to that sort of figure?

Speaker C:We're not going to get there overnight.

Speaker C:This is the kind of moonshot that we want to aim for.

Speaker C:This has been best in class, industry leading, innovative.

Speaker C:We're going to get there long term.

Speaker C:However, I'm focused on bridging that gap.

Speaker C:So for the next 12 months, let's get, let's try and get you halfway between where you are now to those long term percentages which might be doubling their profit, it might be increasing their profit by 50, 40.

Speaker C:So for me, I'm trying to build the, the habit and I don't want to put them on that crash diet, doing too much too soon.

Speaker C:There are some exceptions.

Speaker C:There's some businesses, I'm sure you guys have seen this, when we get them on the scales and we're like, oh my God, we need to lose weight right now, like this is not sustainable.

Speaker C:So there are those situations.

Speaker C:But generally speaking, we want, we want to build the habit and the new muscle memory.

Speaker B:Absolutely.

Speaker B:Yeah, I totally agree.

Speaker B:And yeah, it's really interesting with different people, different types of businesses we work with, some can get there sooner than others, some take a lot longer.

Speaker B:And actually it's not a race.

Speaker B:You know, there's no right or wrong time to get to the, to get to.

Speaker B:The end goal is that it's actually about making that journey and starting to move forward and be more profitable.

Speaker B:Pay yourself more money for your business, have the money set aside for tax.

Speaker B:And for some people you have to start with a vat, don't you?

Speaker B:It's that simple that someone just hasn't got the VAT saved up.

Speaker B:So there's so many different things we can do, but it's a process to work people through.

Speaker B:You use the word habit there, which is the word that I love to hear because we're trying to guide our clients to have the right habits and create a rhythm of the money in their business, aren't we?

Speaker B:So can you, can you tell me in your experience what's the most common misconception that people have got about profit first?

Speaker C:When you've spoken to people, the most common misconception my experience is it's just about cost cutting.

Speaker C:Yeah, they're like, oh, I can do that, I can just save some money.

Speaker C:And they think it's tapping into this kind of scarcity mindset that we're not looking to grow a business because we're just trying to cut all these costs, pay the owner more money and you know, effectively cut the muscle in the business.

Speaker C:But we know as profit first professionals, we don't want to cut the muscle, we want to cut the fat.

Speaker C:And so yeah, the biggest misconception is it's just this short term magic wand hack.

Speaker C:We're just going to cut loads of expenses, make loads of more money and, and then it runs out of steam.

Speaker B:Yeah, totally agree.

Speaker B:It's not a quick fix.

Speaker B:Is it proper first?

Speaker B:It's a change of habit, a change of behavior.

Speaker B:Have you found that, Duncan?

Speaker B:Have you come across that with your businesses as well?

Speaker A:100%.

Speaker A:I really like the similarities with fitness that Stephen was using, because there is no quick fix, there is no easy route.

Speaker A:It's about doing the right things at the right time over a period of time and getting a transformation over 6, 12, 24 months, which in the life of business is not very long.

Speaker A:But when someone's under the cosh, when they're distressed, actually it feels like a long time.

Speaker A:But I love Stephen's approach.

Speaker A:Exactly what we do in our firm by getting the right mindset, getting the right habits and keeping people accountable.

Speaker B:Excellent.

Speaker B:And so Stephen, back to you.

Speaker B:How, how do you use Profit first to help your clients achieve financial success?

Speaker C:Yeah, so I think, you know, success, it can be a lot.

Speaker C:You know, there's financial success and the success in general.

Speaker C:And I don't necessarily, I think financial success is a key part of success, but, but I think that the principles are the same and we need to kind of have a, a plan and a goal that we're working towards.

Speaker C:So if you think success in life in general, you need to know where you're going.

Speaker C:What am I trying to achieve?

Speaker C:What does my ideal life look like?

Speaker C:It's the same with finance.

Speaker C:Success.

Speaker C:We need to know where we're heading and it comes back to those benchmarks we talked about.

Speaker C:So with Profit first, we're mapping that future.

Speaker C:We've got a target to work towards, we've got that long term aim.

Speaker C:And then again, if we look at the parallels for success in general, you're more likely to be successful if you model someone who's already done it.

Speaker C:If you model someone who's done the thing you're trying to do.

Speaker C:If you look at the, you know, I know you're a football fan, Tim.

Speaker C:If you look at the top teams in the Premier League, Pep Guardiola at Man City, who's a bit of an innovator, everyone else copies what he does.

Speaker C:They model because he's had so much success.

Speaker C:So profit first is the same.

Speaker C:Why?

Speaker C:Trying to reinvent the wheel financially and guess, guess and, you know, make all these mistakes.

Speaker C:When there's a model that works, it's worth hundreds of thousands of people.

Speaker B:Yeah, spot on.

Speaker B:Totally agree.

Speaker B:And, and one more.

Speaker B:What's your favorite profit first success story or top tip that you can share?

Speaker C:Yeah, so my, I think Linking into the tip and the story.

Speaker C:The, it's the same sort of principle really.

Speaker C:And it comes back into the mindset shift that I see people have.

Speaker C:And when I talk to new Profit first clients, I don't talk too much about the advanced mindset in, in in innovative, resourceful way of thinking that Profit first enables and uncovers.

Speaker C:But we had one story with a client where he had that mindset shift really quick and basically he, he ran two kind of retail shops in, in the London area and he was about 3/4 of a million revenue business.

Speaker C:And we talked about his model and how he, about his numbers and, and he said, how does this work?

Speaker C:You know, how's it going to save me money?

Speaker C:Because surely all I need to do is cut expenses, do X, Y and Z.

Speaker C:And I started asking better questions.

Speaker C:So when we're talking about advisory, asking better questions, and I said, is one shot better than the other?

Speaker C:And he said, well, actually now you say it, this shop, we're a bit unsure whether it's washing its own face.

Speaker C:But because of X, Y and Z, he told me how many team members were in the business.

Speaker C:I thought it was quite on the high side.

Speaker C:I said, I can't say for certain, but can you go away and maybe think about it and think what would your business look like with less team members?

Speaker C:How would it run itself?

Speaker C:Haven't got the answers.

Speaker C:You've got the answers, it's your business.

Speaker C:And also just think about whether what's profitable, what's not profitable in terms of your, your offering.

Speaker C:And he basically pretty much disappeared.

Speaker C:I think we had two meetings and I didn't see him for three months.

Speaker C:He disappeared and I thought, oh my God, you know, is he doing the work?

Speaker C:Is he going to make any progress?

Speaker C:And he was basically behind the scenes making all these changes since the first two meetings we had.

Speaker C:He went from two shops to one shop.

Speaker C:He went from 12 team members to nine team members and he saved 200 grand in costs.

Speaker C:But his revenue went up.

Speaker B:Wow.

Speaker B:Wow, fantastic.

Speaker B:Now that's making an impact on the client, isn't it?

Speaker C:Yeah, and it helped him pay 100k's worth of debt in the next 12 months because he, you know, got some trouble post Covid and, and basically, you know, it.

Speaker C:This is how you can really build that trust with your clients because we've essentially got a lifelong fan because we've made that transformation, we've had that impact in his business.

Speaker B:That's, that's an amazing story.

Speaker B:Thank you for sharing that.

Speaker B:It's always Great to hear success stories of our members, clients as well as our members.

Speaker B:We love to hear our members success of course, first and foremost.

Speaker B:So tell me, if you're a business owner, when should you start implementing profit first?

Speaker C:I mean the, the best time would have, would have been last year and the next best time is today.

Speaker C:So.

Speaker C:And I would, I would just.

Speaker C:The beauty with the system is we all kind use it a little bit anyway and you know, it might be our personal life.

Speaker C:A lot of people have like a little pot for their holiday, a little pot for their Christmas, a little pot to say for your child's wedding or to save this next big hot, you know, whatever it is.

Speaker C:So we already kind of doing it already.

Speaker C:And how can you start taking some of those habits and apply it to your business?

Speaker C:And you mentioned it Tim, if you're not already putting money aside for your vat.

Speaker C:I would actually start there if you're doing nothing because that really reduces a lot of overwhelm and gives you a lot of clarity and you'll find there's a domino, positive domino effect in your business if you start there.

Speaker B:Yeah, and it's a good thing to bring up actually.

Speaker B:It can be overwhelming, can't it?

Speaker B:Trying to implement everything in one go.

Speaker B:For some people, one step at a time works better for other people.

Speaker B:They're ready to go all in and do every account straight away and work on percentages from there.

Speaker B:But it's an interesting point to bring up, so thank you.

Speaker B:So what would you say to any accountants, bookkeepers or coaches that may be listening to this and maybe considering joining profit first professionals?

Speaker B:What would you say to them?

Speaker C:I.

Speaker C:I'd say if you haven't definitely read the book first, you know, there's a kind of, a lot of people maybe think something might not work or it's not for them, but they've not kind of absorbed themselves or experienced it.

Speaker C:So I definitely start reading the book and my advice would be read the book thinking like a business owner, don't read it thinking like a profit first professional because you need to connect emotionally and if the book resonates with you, just have a chat, just have a conversation and explore, you know, what it looks like in your business because it's transformed our business.

Speaker C:And if you've got the right mindset and you want to help your clients at a deeper level, it's definitely a way of doing that.

Speaker B:Fantastic.

Speaker B:Thank you Steve.

Speaker B:And just for the last one, I'm gonna, gonna bring out.

Speaker B:You used to be called Cheltenham tax accountants but You've rebranded your business and changed your name.

Speaker B:Would you like to share a little bit about that?

Speaker B:And also if you've got any, any, if anyone wants to contact you.

Speaker B:How would they do that?

Speaker C:Yeah, so we previously, originally we were called Cheltenham Tax Accountants because it was our location where we were based and you know, a little kind of side story.

Speaker C:I didn't want my name on my website because I was actually still working for my first employer at the time.

Speaker C:So it was kind of a generic name.

Speaker C:It did help us with the local community and we helped us build the business that kind of evolved into cta, which felt a bit more modern and it was, you know, less of a mouthful.

Speaker C:And recently really we've been wanting to move to something more refreshing, more modern that represents our core values.

Speaker C:So we recently moved to grow, but without the W.

Speaker C:It says Grow Profit First Accountants.

Speaker C:And that's really important to us because our first core value in our business is Kaizen.

Speaker C:Kaizen means continuous improvement.

Speaker C:You know, it's.

Speaker C:And it links into profit first completely 1% marginal gains.

Speaker C:How can we constantly be 1% better?

Speaker C:And we apply that to the team.

Speaker C:If the team are not growing, they're not going to be a good fit for us.

Speaker C:We need everyone to be growing together and even our, our clients, we want them to be growing.

Speaker C:So we just feel it fits our, our kind of mission with who we are and who we want to work with.

Speaker C:So to contact me.

Speaker C:Yeah.

Speaker C:So you can, if you.

Speaker C:It's grow profit first accountants.co.uk is is the website and yeah, feel free to reach out if I can help in any way.

Speaker B:Fantastic.

Speaker B:Thanks, Steve.

Speaker B:And do you still run a Profit First Club online?

Speaker C:Yeah, so we, and we're trying to build this.

Speaker C:It's a great way of, you know, getting business communities to together.

Speaker C:So we, I have the, the Profit First Club newsletter which is on a platform platform called Beehive.

Speaker C:So you can get lots of Profit first tips and business tips and mindset tips on there.

Speaker C:And we're also actually currently working on, we're calling it the Grow Profit Hub where we're looking to build resources, training to help people grow their businesses.

Speaker C:It's designed for existing clients, but there also be a way of other people accessing that as well.

Speaker B:Thanks, Steve.

Speaker B:You know, it's always a pleasure talking with you.

Speaker B:I always enjoy our conversations.

Speaker B:We have them regularly as one of our members.

Speaker B:So thank you very much for joining us today.

Speaker B:And Duncan, is there anything you'd like to like to add or summarize up on our conversations.

Speaker A:Just a big thank you to Stephen for being an ambassador for Profit first and for the impact he's making on his customers lives for his team and ultimately for himself and his family.

Speaker A:Keep up the good work, Steve.

Speaker A:Thank you very much.

Speaker C:Yeah, amazing.

Speaker C:Thanks, guys.

Speaker B:Thanks very much.

Speaker B:Great to have you on.

Speaker B:Thank you very much.

Speaker B:Thank you for joining us on our podcast today.

Speaker B:Profit First Beyond.

Speaker B:The book was brought to you by by the Profit First Professionals UK and Ireland team.

Speaker B:If you'd like to find out more about Profit first or becoming a Profit first professional, head to our website, profitfirstuk.co.uk.