Why Management Accounts Don’t Work for Clients – and What to Do Instead

Tim Seymour is joined by Deb Halliday and Jason Withers to unpack a harsh truth: most management accounts are built for compliance, not clients. They're full of jargon, backward-looking, and fail to help business owners make smart decisions.

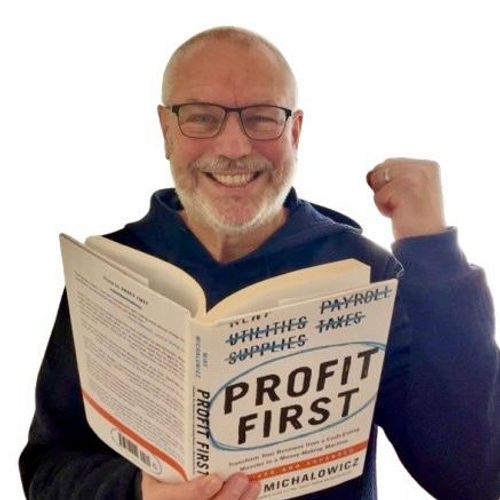

In this episode, we explore why traditional reports often confuse more than clarify - and what accountants and bookkeepers can do to change that. The conversation dives into how shifting from compliance to advisory work, and adopting Profit First, can radically improve the client experience, boost understanding, and drive better financial outcomes.

You’ll learn:

✅ Why clients struggle with traditional management reports

✅ How the Profit First method simplifies financial decision-making

✅ Real examples of how advisory work increases client income

✅ What it looks like to become a forward-focused, client-first advisor

Whether you're already on the Profit First journey or just starting to explore, this episode offers clarity and inspiration on delivering real value to your clients.

Transcript

Foreign.

Speaker B:Welcome to Profit first beyond the Book, a podcast that takes you beyond the book with Profit first brought to you by Tim Duncan and the rest of the Profit first professionals, UK and Ireland.

Speaker C:Foreign.

Speaker B:Welcome to another episode of Profit first beyond the Book.

Speaker B:And today I am joined with Deb and Jason.

Speaker B:Welcome.

Speaker A:Hi, Tim.

Speaker B:Thank you.

Speaker B:I'm laughing.

Speaker B:I'm welcome.

Speaker B:As we need to get better at this as we go.

Speaker B:Anyway, we've just been on the, the Profit first pathway.

Speaker B:Within the Profit first pathway, we've been hosting a challenge called the five Friday Profit First Challenge, which we've done over five weeks as opposed to five days to allow the accounts and bookkeepers time to take action on, you know, throughout the week on the homework and the assignments we set them and it seems to be working really well.

Speaker B:We've got good retention of people turning up, you know, consistently to the calls, I feel.

Speaker B:And yeah, we just wanted to share with everyone the kind of topics that we were talking about today.

Speaker B:So I'm going to open it up with a slightly controversial statement.

Speaker B:A lot of influential people within the accountancy and bookkeeping world who arguably are competition, I suppose you could call it when we talk about adding Advisory is an offering for accountancy bookkeepers to put with their, with their clients.

Speaker B:A lot of people are telling you to get certain softwares, produce reports, management account reports and, and fluffy reports and make them look really nice and, and professional and send them to your clients.

Speaker B:Clients don't want it.

Speaker B:Business owners do not understand the reports that they're being sent right now.

Speaker B:They don't understand management accounts.

Speaker B:Management accounts are created by accountants for accountants.

Speaker B:And I think that's a fact.

Speaker B:And I think throughout that call we just had, we kind of came to that realization as well from the people on the call.

Speaker B:We're all nodding their head in agreement that they need to run the management account so they can understand what their client's doing, but it actually serves no purpose in giving it to their client because a client can't read it.

Speaker B:Would that be a fair summary of some of the conversations we had, Jason?

Speaker A:I think so.

Speaker A:One of the things that has always struck me through time actually is that I've always thought of management accounts being the moment that the conversation starts.

Speaker A:And I think for a lot of people in the accounting world, management management accounts actually become a full stop to the conversation however they end up being delivered.

Speaker A:Be that face to face through a video, you know, reporting call, whatever it might look like.

Speaker A:And it's like there is this feeling that the job is Done when that information has been presented.

Speaker A:And yet, because of my background, because I generally have this commercial take on how I think about doing work with clients in a financial sense.

Speaker A:It's like, okay, give me the management accounts.

Speaker A:What are we going to do next?

Speaker A:Is really where I'm coming at it from.

Speaker A:It's like, okay, I want to know what the factual piece says.

Speaker A:I can interpret it.

Speaker A:And it's down to me to then translate that with a client into what it really actually means that we can do with their business.

Speaker A:Yeah, you know, what are the indicators?

Speaker A:What is, what is happening is the numbers going up and down, all of those things.

Speaker A:But it's like that should be the start of the conversation with a client, not the end.

Speaker A:And I get this sense that at the moment it's like, yeah, produce more, produce more, produce more.

Speaker A:Only to create a full stop in the conversation.

Speaker B:Yeah, yeah.

Speaker C:Go on.

Speaker C:Sorry, Tim.

Speaker C:I was gonna say, I would agree with that.

Speaker C:That's what I've come across within the accountancy and bookkeeping world.

Speaker C:It's been transferred to or add advisory, but it will be in the form of a software reporting package.

Speaker C:Have your three tiers, you know, report only with video or in a meeting.

Speaker C:But it's literally just translating that data as in performance.

Speaker C:This is what you've done.

Speaker C:You might have done better this month than you did the previous month, but there's no forward looking, there's no forward planning.

Speaker C:And it seems to be just something that we can add on to increase our fees.

Speaker C:But no real thought has gone into the benefit of.

Speaker C:For the client.

Speaker C:Now we can read them.

Speaker C:We understand the data, we understand the importance of the data, but the clients just want to know if they can make a decision.

Speaker C:And they want to know if they can make future decisions not, not based on, you know, their profit margins.

Speaker C:Whatever they achieved last month, it's got to be what they can achieve in the future.

Speaker C:But it's.

Speaker C:That seems to have been lost a bit, I think, in the, in the messaging.

Speaker C:Yeah.

Speaker B:I think, I think we have to reflect back on what actually do our clients want?

Speaker B:What, what do they want from us?

Speaker B:Some of things we spoke about during the session just now, it became quite clear that business owners don't actually realize what accountants of bookkeepers can do for them.

Speaker B:And, and so, you know, because we don't tell them, we don't tell our clients what we can do for them.

Speaker B:So we think, oh, we're produce management accounts.

Speaker B:That's a monthly job I can do, therefore I can put them on for a monthly recurring fee and I can charge them monthly and then that's a tick in the box of doing a good job.

Speaker B:Yeah, I've increased my fees slightly.

Speaker B:I've got the costly VAT return to do.

Speaker B:So that adds a bit more to what I'm doing.

Speaker B:I can charge more money, but there's no value being delivered.

Speaker B:And I think the key part of this is how can you make an impact on your client's business?

Speaker B:We know that Profit first is the main answer to this question because the structure and the framework of Profit first and being able to provide clarity on the money in the business, being able to say, do you know what?

Speaker B:This is where you're at right now for a profit assessment.

Speaker B:This is how you've handled your money up into this point in your business.

Speaker B:Great.

Speaker B:Here's a plan to move forward.

Speaker B:Here's an actual plan where we can see you increasing the amount of money you take from the business yourself.

Speaker B:This isn't going to come out of an overdrawn director's loan account, by the way, because we are going to actually strategize and make sure that everything you are bringing into the business is used in the correct way to serve you best.

Speaker B:Now that is adding value and that is adding impact.

Speaker B:And Jason, you talked about the value of moving someone who owns a business from taking £30,000 out of the business to £50,000 out of the business.

Speaker B:Can you elaborate on that please?

Speaker A:Yeah, I think it's one of the most simple examples of what it really means to give advisory to a client.

Speaker A:This, this notion that it's like, oh, okay, increasing pay.

Speaker A:Who doesn't want to increase their pay?

Speaker A:Well, everybody whose accountant is telling them they'll get a bigger tax bill.

Speaker A:You know, we handle that very cleanly within the profit first environment of planning for that.

Speaker A:So I'm definitely on, on the side of the fence, which is let's earn more because we can always provide the right amount of tax to cover it.

Speaker A:That's just part of the planning.

Speaker A:And it's the most natural thing in the world for me to do with clients.

Speaker A:I think one of my realizations around it is when I, when I started out in my own business 15 odd years ago now, I thought every business wanted to make a profit, they wanted to make more money.

Speaker A:It's like that's what they were in it for, more profit.

Speaker A:I must make more profit.

Speaker A:I need to know about the profit.

Speaker A:The realization for me was they actually couldn't care less.

Speaker A:What they really wanted to know was Have I got enough money to pay myself on a Friday afternoon?

Speaker A:That actually was the real desire.

Speaker A:And hopefully, yes, from a technical point of view, there was profit there that would support them being able to do that.

Speaker A:But they weren't focused on the profit.

Speaker A:They were focused entirely on the cash.

Speaker A:Can I actually pay myself this money today, safely, sustainably?

Speaker A:And I think that that is a big realization because we, we focus on, as you say, delivering, you know, this, this management information.

Speaker A:But the reality is none of it helps a business owner make a decision today.

Speaker A:It's, it's literally down to it's, sorry, bizarre phone call.

Speaker A:It's literally, it is literally down to all of the information we're producing is entirely historic and doesn't help them make a decision today.

Speaker A:Cash and understanding what they have, the purpose that it holds in their business, gives them the ability to make a decision in real time.

Speaker A:And for me, that's one.

Speaker A:It's one of the most simple ways to explain why management accounts are the full stop in a conversation.

Speaker A:As it stands at the moment, there is a secondary part of the conversation that needs to be had to actually help the business owner.

Speaker A:So getting back to the reframing of the 30,000 to 50,000 idea, that's a massive change for a business owner.

Speaker A:It's like, you know, 67% increase in their pay.

Speaker A:That has to be worth something.

Speaker A:For us as advisors, coaches, consultants, whatever words we choose to use to help a client get to that point, and they need help to, to get to that point, they won't be able to do it themselves most of the time.

Speaker A:To be able to put them on a pathway that is structured, that shows them how that progression will happen must be worth something.

Speaker A:And this is the thing the idea of the exercise that we did with the group this morning was very much about.

Speaker A:It is in the value of the transformation.

Speaker A:It's not about working harder.

Speaker A:It's not about producing more information.

Speaker A:It's not about ticking off another box.

Speaker A:It is about understanding the value of that transformation, that 67% pay rise in this particular example, to that business owner.

Speaker A:How much do they value that change in their personal life?

Speaker A:I'll just follow up.

Speaker A:Actually, the other tip that I gave right from the beginning of a discovery call, sales call, whatever you want to call it, with my prospects and clients, the business owner for me, sits above their business.

Speaker A:So my conversation is entirely focused around what that business owner is going to get out of their business.

Speaker A:From the very first time we have a conversation and decide whether or not it's Appropriate that we do work together and all the other things that go with that.

Speaker A:Because I know that if we are focused on that business owner, I know that we will correct a lot of things within the business on that journey in order to give the business owner the outcomes that they desire.

Speaker A:It's not an overnight fix.

Speaker A:It is a progression towards something.

Speaker A:And that for me, I think it's a great exercise to do because it's a very simple idea.

Speaker A:30,000 to 50,000, massive increase in value for the client.

Speaker A:But how do we value that as an advisor and how do we get comfortable with the idea that is worth something?

Speaker A:And there is a legitimate charge for creating that transformation for a client.

Speaker A:Sorry, bit rambly in there, Tim, but hopefully we covered the point.

Speaker B:That's okay.

Speaker B:It's a whole world away from producing management accounts and expecting your client to be happy that you've done that for them, you know, because you delivering pain signs, you know, you're delivering them some money and actual cash in their hand.

Speaker B:Now, that is something that people will pay for.

Speaker B:And also we're delivering time, so time and money.

Speaker B:If you can give that to your clients, that's impactful, that's transformative, and that will be what they will increase their fees to you for.

Speaker B:Deb, we also spoke about statutory accounts that account as a bookkeepers have to produce being for the taxman.

Speaker B:You know, in effect, you know, we're set up as agents, aren't we, and we act for the tax man.

Speaker C:Yeah, I mean, that conversation came around because I was on another podcast and the business owner asked me, why can't business owners.

Speaker C:Why aren't we taught how to read profit and loss, balance sheet, cash flow?

Speaker C:And I said, because they weren't created for business owners.

Speaker C:They were created by the tax man.

Speaker C:And same as double entry, it was all created by the monks who used to collect the tax for the tax, for the landowners, for the church.

Speaker C:So it's.

Speaker C:What we said in our session is it's created from accountants or accountants.

Speaker C:So with Mike being a business owner and creating first, it's a situation system for business owners and it hasn't got all the jargon, it hasn't got all the.

Speaker C:The complicated formulas or graphs.

Speaker C:And what do they call it when you've got like little.

Speaker C:Just letters.

Speaker C:What's it called?

Speaker B:Kpos.

Speaker A:Acronyms.

Speaker C:Example Key performance indicators.

Speaker C:Nobody knows what these initials stand for, do they?

Speaker C:Nobody knows.

Speaker C:And it's just you give people the reports and expect to be able to read them even if you give them a Translation lesson, still not in their language.

Speaker C:Is it so what we deliver.

Speaker C:And the advisory should be, the advisory should be in the language that they understand.

Speaker C:And what they understand, tax, they understand, owners pay, they understand what operating expenses are.

Speaker C:So it's just talking to them as fellow business owners and not from the place of being an accountant speaking a different language.

Speaker C:They absorb it, they understand it.

Speaker C:It's a simple system.

Speaker C:And it's easy for them to be able to make the decisions because they don't want to look at spreadsheets, they don't want to look at another report.

Speaker C:And it's hard enough sometimes getting to look at their own bookkeeping software, but to look at their bank, bank accounts every day, that's just part of their normal behavior.

Speaker C:So, yeah, I think we've kind of like lost as accountants.

Speaker C:We've lost that.

Speaker C:Did we ever have it?

Speaker C:Did we ever.

Speaker C:I mean, are we a different breed?

Speaker C:Do we expect business owners to want to understand the profit and loss and the balance sheet?

Speaker C:Because we do.

Speaker C:I don't know.

Speaker C:But I found it, I myself have found it much, much easier talking to clients, business owners, on profit first basis than any other report.

Speaker C:So, yes, I didn't really want to be sending management reports, even if they did look all lovely and fancy in full color.

Speaker C:And you can move, move the graph or whatever, it just, I could just see the clients glaze over with it before I even did it.

Speaker C:So, so, yeah, so in a way.

Speaker B:We'Re putting our clients into an uncomfortable position because we're sending them report, financial reports that they are not trained to read, you know, that they, they don't necessarily understand.

Speaker B:Okay, so one client in 100 might understand, you know, but, but a lot of clients, the majority of clients don't understand.

Speaker B:And then they're made to feel uncomfortable because they think they should understand what you're talking about.

Speaker B:So they kind of nod their head and agree just to get off the call because it's uncomfortable.

Speaker B:Don't know what they're talking about.

Speaker B:Yeah, it's all under control.

Speaker B:I'll leave it up to you.

Speaker B:It's fine.

Speaker B:And they're off.

Speaker B:You know, they, they don't get the value from it.

Speaker B:Whereas, and we all know that they will make a decision based on the amount of money in their bank account because that's natural human behavior.

Speaker B:How much money have I got?

Speaker B:Okay, I can buy that.

Speaker B:Full stop.

Speaker B:That's what people will do.

Speaker B:And that's why Profit first gives so much clarity to business owners, because we take out money for profit.

Speaker B:We take out their owners pay so they can pay themselves at the end of the month and they don't spend it on an impulse buy.

Speaker B:You know, we take out their tax money, we take out their VAT money.

Speaker B:We, you know, we, we, we leave what's left for their operating expenses to run their business.

Speaker B:And when there's less money in their bank account, they think a little bit harder before they make a decision on whether they're going to buy something.

Speaker B:And I think that's the key driver for me.

Speaker B:And I love what you mentioned, Deb, about Mike, creating Profit first as a business owner.

Speaker B:For fellow business owners, I think that's really key.

Speaker B:But he also created Profit First Professionals so that accountants and bookkeepers could learn properly through certification, through a program that's delivered by being a Profit First Professional.

Speaker B:Then they can work with clients and help their clients and deliver value because they've had to implement Profit first their own business through our trainings, and they get continual professional development and training as they go through.

Speaker B:The longer you're a member, the continual training just goes on and on and on and you learn from your fellow members and in the community.

Speaker B:So just thought I'd add that bit in as well.

Speaker B:Jason, you shared with us a lot of things about your journey.

Speaker B:And one of the things that we support our members within Profit First Professionals is once they're certified, they want to go out to the world and deliver Profit First.

Speaker B:Of course, course.

Speaker B:And we talk to them about talking to their clients first and foremost.

Speaker B:And then the marketing and the, the talking to external clients comes, network prospects comes next.

Speaker B:Within people's client bases, they, they, they have probably some golden nuggets, but they might not realize because again, the customer doesn't necessarily know what you can deliver for them.

Speaker B:So, and what happens quite often is we say to people that when you first start delivering Profit first first you might not charge very much, but the first two or three people you work with, you'll charge some money.

Speaker B:The next few, your confidence will grow, you'll charge a bit more money, and the next few you'll charge even more money.

Speaker B:And in time you'll get to that point where you're charging what you feel is the right amount to be charging, but even that can still keep moving forward.

Speaker B:So you kind of shared the progression of fee increasing with us.

Speaker B:Would you like to elaborate on that fee for our listeners on the podcast, please?

Speaker A:Yeah, sure.

Speaker A:I think like most things, we're always trying to strike that balance.

Speaker A:Certainly in the early stages of a business of needing Some income and trying to not work too hard for the income at the same time.

Speaker A:There is a very fine balance in there.

Speaker A:And I think for established business owners there will be things that we would all look back on and say, yep, knowing what I know now, never would have taken that client on.

Speaker A:But the reality is we have to start somewhere.

Speaker A:My starting point with profit first I was charging one 27 pound a month.

Speaker A:And my idea in the beginning was I would put, I think it was like six or eight weeks of effectively a one to one course together for what it was worth to take people through an implementation and then try and work out what we were going to do on the back end.

Speaker A:By about week three, I was bored of my own delivery and I realized I was actually just regurgitating the book and probably not very well.

Speaker A:But by that stage I was being asked questions and it became a bit more interactive as a process.

Speaker A:And I started to realize that the questions I were getting didn't really have anything to do with the technicality.

Speaker A:It was about how they were going to get more out of the system.

Speaker A:So I got to a point after trying to take two or three clients through this, where I just basically ditched my whole approach and basically just jumped in at the deep end.

Speaker A:It's like, okay, where are you now?

Speaker A:And typically I'd get them to, you know, share their zero or QuickBooks or whatever so I could get a flavor of what the breadcrumbs of history look like in the business.

Speaker A:But I would dive in straight at the deep end, as it were, and say, okay, right, where are we going?

Speaker A:What's going to happen next?

Speaker A:And that actually for me was, was a revelation because they suddenly became engaged in the conversation.

Speaker A:Well, I'd like to earn this much in the future.

Speaker A:I'd like to take on another team member.

Speaker A:I'd like to go on holiday.

Speaker A:So all of the dialogue that I was having was very future focused and it was very much about them as the business owner, really just going back to what I was saying about what they wanted.

Speaker A:Really didn't have much to do with their business at all.

Speaker A:It was about their hopes and desires and dreams and things they wanted to do.

Speaker A:And it completely revolutionized my pricing over a period of time, but also the structure of delivery for me.

Speaker A:So 127 was where I started.

Speaker A:I then moved that up to about 197amonth.

Speaker A:I think that moved to 297 and then it was combinations of 3, 9, 7, some 4, 9, 7amonth and some of that was about business size, how complex they were to deal with.

Speaker A:And let's face it, 2, 3, 400, 500 pound a month is not mega consultancy money.

Speaker A:You know, we're not suddenly saying, oh, this is £2,000amonth and I'm going to do whatever I'm going to do.

Speaker A:It's like this is comfortable, this is easy.

Speaker A:And so my, my, my way forward in my own mind was really about saying some people are buying into this, okay, I'll try, I'll try a higher amount.

Speaker A:But I didn't really have any function behind it.

Speaker A:It took me going through the reps, the iterations, the range of clients, the circumstances, to understand where the points of value were really coming out in those conversations.

Speaker A:And once I got to grips with the idea, this whole thing about the value is in the transformation, once I'd really got to grips with that idea, the rest became very easy.

Speaker A:From a pricing point of view.

Speaker A:It was very easy to talk about the transformation that that client wanted right up front on that discovery call, on the sales call and say, yeah, this has value to you, I can help you do that and achieve that over a period of time.

Speaker A:And there is a charge for doing that if it means this much to you.

Speaker A:Here is something that matches that at my end as well.

Speaker A:So I think it is one of the things that, you know, we see a lot about the, you know, oh, go to advisory because that's, you know, it's more money.

Speaker A:It's not if you can't grasp the idea that the value is in the transformation.

Speaker A:And, and for me, I always think about it like the client's business is happening in the future.

Speaker A:That's where they need to make decisions.

Speaker A:That's what the decision they make today is going to govern what happens in the next week, the next month, the next quarter.

Speaker A:It's not about what happened three months ago.

Speaker A:It's not because I looked at a graph last week.

Speaker A:It is because we have an innate understanding of where they want to go in the future.

Speaker A:And that I think is that conversation drives that idea of transformation to me.

Speaker A:It makes it very easy to have context around pricing at that point in time.

Speaker A:Because understand it has value to them.

Speaker A:Let's face it, four or five hundred pound a month, as I say, it's not rock star money.

Speaker A:At the end of the day it's comfortable, it's easy, it's not a massive leap for a client.

Speaker A:It is a simple premise to get going.

Speaker A:I think the real piece of understanding with that is for me how being Able to think about creating transformation for a client and how that gets priced and the value attached to that is a world away from my old sort of outsourced FCFD type business, which was about how many hours work can I do, can I find some more work to do to bill another hour?

Speaker A:So I would also say one of the things it's done for me is there is, if you like, that headline, monthly retainer rate.

Speaker A:But I've also got an example of a client that I signed on in June.

Speaker A:397amonth, not rockstar money, but that has effectively 3x'd my old style day rate.

Speaker A: That's a: Speaker A:How that equates to, in terms of the time it will take me to deliver for that client across a year.

Speaker A:So I think going back to what you were saying about valuing time and money, time is something we forget about a lot in that equation.

Speaker A:And I know that I'm basically buying myself time.

Speaker A:I have a process, I have a structure.

Speaker A:I've been doing this for a long time now.

Speaker A:But I think that is one of the benefits for our members.

Speaker A:We are getting them into a position where we are opening the mind about these things and we have the ability to accelerate their learning curve now because of the collective experiences that we've had to help people move forward and grasp these ideas faster and understand where the true value lies.

Speaker A:And it's not in producing a set of management accounts.

Speaker A:That's just the start of a conversation.

Speaker B:And it's fair to say, just for clarity, for anyone listening, Jason, you don't offer compliance, you don't do any data entry.

Speaker B:This is pure coaching we're talking about, if you want to use the word coaching, but this is pure consultancy work.

Speaker A:Absolutely.

Speaker A:There's, there's no chasing, there's no compliance deadlines, there's no processing as such.

Speaker A:Very simple and straightforward.

Speaker A:And I, I shared this morning what I would call the shape of my business going back a couple of years now, but that basically looked like 40 hours of delivery a month, including prep time, two days a week.

Speaker A:Basically that was it.

Speaker A:That was client delivery.

Speaker A:Super simple, nice coaching business, comfortable balance of work and general life.

Speaker A:Things didn't want to take over the world necessarily Comfortable for me.

Speaker A:Does a job fits nicely.

Speaker A:No stress, no regret about what I'm charging people.

Speaker A:And I know that because of the value that sits in there, I know it is on me to decide that actually I should do an extra call with a client in a month because we're at a point in a conversation, I might want to go away, do a bit of work in the background, come back to him and say, I think we should hop back on a call.

Speaker A:There's none of this kind of like, oh my word, it's another hour out of my diary.

Speaker A:It is entirely my choice to give that extra hour knowing that the value is respected.

Speaker A:There's no like, oh my God, that's just like made me, you know, £100 down to £50.

Speaker A:It's like it's halved my return.

Speaker A:There's none of that kind of thinking.

Speaker A:Super comfortable, super easy, more than happy to do those calls when they're required.

Speaker B:Yeah.

Speaker B:And for you, as a general rule of thumb, when you first take on a client, maybe three or four hours in the first month, but other than that it tends to be one hour a month, doesn't it, of delivery and that 10.

Speaker A:Yeah.

Speaker A:I mean there is context in there.

Speaker A:This particular client that we've just referenced, simple service based business, I would expect through a combination of doing some background work and setup, having probably two calls with them to make sure we're absolutely in line with where we're going to go next.

Speaker A:That might be four hours of work this month and then hour a month thereafter.

Speaker A:Yeah.

Speaker A:You know, it's like one of these things for me is it is about the time but that has only come through learning how to structure my time in terms of how I deliver as well in order to create a transformation for a client on an hours call.

Speaker A:Simple, straightforward process.

Speaker B:Brilliant.

Speaker B:Thanks Jason.

Speaker B:And Deb, Deb, your, your pricing structure was slightly different.

Speaker B:So, so we've, we've, we've talked to Jason coaching business.

Speaker B:Now we're, now we're going to come to Deb bookkeeping business with profit first advisory added on the top as the cream on top of the, the cake is how I like to describe it.

Speaker B:So we, when I, when I had my accountancy business and I went through profit first, I went all in on value pricing.

Speaker B:So value pricing was the thing, you know, the classic gold, silver, bronze.

Speaker B:Didn't call it that but you know that was, that was the classic thing and I targeted the middle package and it worked for me.

Speaker B:It worked a treat for me.

Speaker B:But what I like about what you did Deb, is you put your own twist on the value pricing model of the packages, didn't you?

Speaker B:So do you want to share a little bit about that?

Speaker B:Because I think how we price is really important for accountants and bookkeepers to hear.

Speaker C:Yeah, it, it transitioned I mean originally, before I was profit first, when I was just a solo bookkeeper, it was hourly rate and it was always too cheap.

Speaker C:Then I looked at value pricing, the, the typical three tiers, the gold, silver, bronze.

Speaker C:But that evolved for me because I could, I knew that people would choose the middle package and that was fine.

Speaker C:But I used to work for a training company before I was a bookkeeper.

Speaker C:And we had programs where they, we would assess where the student was in their learning journey.

Speaker C:So if they were basic as in a starter, they would go on the proficiency program and then it would go to expert and then it would go to master.

Speaker C:And as they learn and as they progress, they would go through the, the program.

Speaker C:So I decided actually that I would grade my clients similarly.

Speaker C:So if they were under the VAT threshold, I considered that solo starter and I would take them on.

Speaker C:But they had to want to move above the bat threshold within 18 months.

Speaker C:And that way I knew that I was getting the type of clients that wanted to grow, were passionate about their business and weren't limiting their revenues specifically to stay under the VAT threshold.

Speaker C:Because when you work the profit first percentages, 50% is 45,000, now 90 the VAT threshold, then it was 85.

Speaker C:So less nobody's going to want to run a business long term.

Speaker C:45,000.

Speaker C:So I had my solo starter for under the VAT threshold, but they would move to the growing program within a minimum of 18 months or a maximum of 18 months if they came to me over the VAT threshold or they wanted to grow immediately, then be ongoing program immediately we had capacity for that.

Speaker C:But we would use profit first in both programs.

Speaker C:And profit first was the starter block, if you like, the starting piece, so that we could see which areas of their businesses needed attention first.

Speaker C:And then we put them through a series of, we had budgeting, debt removal, owners pay, we had KPIs and growth modules, risk assessments and eventually exit planning.

Speaker C:But we could pick and choose the modules as they grew.

Speaker C:But we, most importantly, as their turnover grew, our fees went up.

Speaker C:So it's a scaling.

Speaker C:So the idea was, and it was structured on a, on a PDF that they could see where they started based on their turnover.

Speaker C:And the idea was for them to gradually but systematically move up the ladder and they could stop where they felt comfortable because not Everybody wants a 2 million pound business.

Speaker C:Some people are happy at 600,000 or whatever's comfortable for them.

Speaker C:It's all about their lifestyle and their time that they want out of the business as well.

Speaker C:But we wouldn't just give them a price based on their turn.

Speaker C:I would give them the, the price sheet and they could see where they're likely to, to go.

Speaker C:So, and the scale that we would take them up.

Speaker C:So that worked really, really well and I just, I just took the approach that we're the experts, we should be telling them what they should be addressing in their business.

Speaker C:That's why they've come to us.

Speaker C:And this is the process that we take you to get to your target of where you want to get to.

Speaker C:So, yeah, so that's, that's how I put my, my quirk on the, on the packages, if you like.

Speaker B:Yeah.

Speaker B:And, and I think as well, you know, a lot of accountants and bookkeepers struggle with increasing fees.

Speaker B:But if you've got it set from the beginning that actually as your business grows, your fees are going to increase because you're on this package.

Speaker B:That's how it is.

Speaker B:There's no argument, it's just done.

Speaker B:And your fees go up because you're doing more work and you're covering more angles for the client, but you're also helping them grow and you're helping them whilst their, their revenues grow and you're helping them to make sure they're still paying themselves enough out of their business and they're still making the right, right level of profit, you know, percentage based, etc.

Speaker B:So we, we don't encourage people to grow for the sake of it.

Speaker B:We're encouraging them to grow under a certain structure through the profit first framework that delivers for them, not just growing for the sake of growing.

Speaker B:So I love the way that you had that structured there.

Speaker B:I think it really helps people be able to understand how they can price effectively.

Speaker B:I also love the fact that when someone joined you as a client, you didn't give them a choice of the packages, you told them where they fitted in to your business model.

Speaker B:And I think that's a key point.

Speaker B:You don't just choose whether you're gold, silver, bronze.

Speaker B:Bronze.

Speaker B:I actually tell you which one you're in because I want to take you from there to there.

Speaker C:Yeah.

Speaker B:So, yeah, fantastic.

Speaker B:Yeah, thanks, Deb.

Speaker B:And I think, you know, we are talking about pricing now in relation to advisory, but they go together so uniquely because like we say, everybody talks about moving forward from compliance to advisory.

Speaker B:Every man and his dog is telling accountants and bookkeepers, you know, AIs come here, move away from compliance.

Speaker B:Compliance is getting price shot.

Speaker B:Ad advisory on.

Speaker B:Yeah, I think everybody knows, you know, that compliance is a difficult market to be in because if you're, if you're competing on compliance only, unfortunately, you can get price shot and it can be erased to the bottom.

Speaker B:Despite the fact that there is a lot of expertise going in to completing the compliance work.

Speaker B:You know, everyone's gone through a lot of qualifications to have the knowledge to better do this correctly, to better, you know, look at tax efficiencies and deliver the right results.

Speaker B:But unfortunately for accounts of bookkeepers, that is the way of the world.

Speaker B:That's just how things are.

Speaker B:And that.

Speaker B:And business owners will just look at you in a way that you.

Speaker B:I need you, because you're working for the tax man, to collect tax on my behalf.

Speaker B:But I need to get these.

Speaker B:These reports submitted, the financial statements submitted.

Speaker B:I have no idea what they say, but you just need to do them for me, because legally I have to.

Speaker B:I have to be compliant.

Speaker B:Whereas with advisory or adding value, whichever way you want to look at it, that's where you can determine how you can make an impact to your.

Speaker B:To your clients.

Speaker B:And, Jason, you talked about transformations, and we talk about, you know, adding value to our customers and stuff, and it comes from what they want to achieve in their business, doesn't it?

Speaker A:Totally.

Speaker A:You know, I think it is.

Speaker A:I think it's imperative.

Speaker A:You know, it's like, it's not my job to make them more revenue or find them more clients.

Speaker A:That's entirely on them.

Speaker A:Addressing the things that matter to them is the absolute imperative.

Speaker A:Our ability to translate financial information, our ability to consume a set of management accounts, and it gives us clues.

Speaker A:I do some management accounts work for some of my clients.

Speaker A:I talk to them about it in passing, but it's always translated into, what does this mean for you in cash terms in the future?

Speaker A:So here we are.

Speaker A:Yes, I'm looking for some performance indicators.

Speaker A:And a lot of the work that I do with my clients has a very commercial edge to it, as opposed to a straight financial edge.

Speaker A:So that's the dialogue that's part of my attraction with my clients, that we have those conversations.

Speaker A:You want this?

Speaker A:How do we do it?

Speaker A:Is that through team members?

Speaker A:Is it because you're going to run webinars?

Speaker A:Have you got a launch funnel underway?

Speaker A:All of these things.

Speaker A:But it's like, what do you want to get out of it?

Speaker A:How do we protect you in the interim to make sure that that is possible?

Speaker A:And I think one of the things that we don't talk about enough is the fact that most business owners get left behind in their owner's pay packet as their business grows.

Speaker A:And there's all sorts of reasons for that.

Speaker A:But it's like the intention for me with all of my clients is we're going to move your income forward.

Speaker A:Every single quarter.

Speaker A:Whether it's possible or not will be dictated by all sets of trading circumstances and reeves falling in and a brilliant launch and all the things in between.

Speaker A:But the intention is to continually move that owner's pay line forward.

Speaker A:And I think it's one of those things.

Speaker A:It's like the business owner feels supported.

Speaker A:There's none of the, oh, you can't do this and you shouldn't do that.

Speaker A:It's like, how far can we push it?

Speaker A:Because if we can push it, like there's going to be a ton of other good stuff going on in your business as a result.

Speaker A:Be that extracting you from day to day delivery in your business and having a team of people who deliver for you, all these sorts of things come into play.

Speaker A:And that also plays into what do they want to do with their time.

Speaker A:It's one thing earning the money, it's quite another having no time with which to do anything with it.

Speaker A:So, you know, this whole idea for me is as businesses grow, I want to make sure that business owner is front and center and they know they will not get left behind in their owner's pay line as their business grows.

Speaker A:It's like that's the conversation.

Speaker A:All the other things hang off of that.

Speaker A:But they know they are front and center in our conversations.

Speaker B:Yeah.

Speaker B:And Deb, how can a candidates and bookkeepers make this happen in their business for their clients?

Speaker C:How can they make it happen by becoming a profit first professional is the obvious answer.

Speaker C:And they can't do it without being a profit first professional with the system that we use.

Speaker C:But yeah, start having conversations once you're certified with your clients having a look at the data to see where the areas of improvement could be and open the conversation about where do they want their business to be heading, what do they want this business to provide for them?

Speaker C:That's ultimately the conversation we should be having.

Speaker C:Why do you start your business?

Speaker C:What is it that you want out of your business?

Speaker C:Because ultimately it's got to fund their lifestyle, isn't it?

Speaker C:And they've got, they've got lifestyle goals, whether it's house moving, expanding the family, going on holidays, retirement, going on cruises or family events.

Speaker C:Everybody's got dreams and goals that they want to talk about actually.

Speaker C:And if you can talk about them and then start putting it into, into a plan and then they start actually realizing that they're going to be able to implement these and have a timeline of when they want to achieve their goals and then run that business to that timeline with your sales targets, with your revenue targets and your team building targets.

Speaker C:And how are you actually going to have this, this vehicle which is your business, transport and fund your lifestyle goals?

Speaker C:That's ultimately what we end up doing as Profit First Professionals.

Speaker C:Which is far more exciting than just showing them a P and L or a balance sheet, isn't it?

Speaker C:So it's far more exciting.

Speaker B:And of course, the great thing about being a Profit first professional is that accountants and bookkeepers get to learn the strategies because they're living and breathing Profit first in their own business.

Speaker B:And we effectively are their Profit first professional.

Speaker B:So we guide them through the whole process.

Speaker B:They get to learn the points of resistance, the obstacles, they get to see the value, they get to get clarity on their own numbers.

Speaker B:They understand there's a pathway here that they can follow to be a lot more profitable, to pay themselves a lot, a lot more to be able to achieve their outcomes.

Speaker B:So we're not just transforming clients.

Speaker B:Our members are seeing transformations in their own lives and their own business.

Speaker B:You know, Hetty just went to New Zealand this winter, didn't she, to visit her son, who she hadn't seen for a few years with her daughter.

Speaker B:And she, by her own admission, could not have done that without Profit first being in her business.

Speaker B:She's one of our members, she's a Profit first professional.

Speaker B:She's also smashing it with her clients.

Speaker B:But I use her as an example because it's an obvious outcome that's been achieved by one of our members.

Speaker B:So our members achieve their outcomes.

Speaker B:Our members are transforming their own businesses, businesses, but also they are then able to transform their clients, businesses, which then enables them to command higher fees, which means they can, they can start to look to their other outcomes, their next dreams, their next things that the accountants but want to achieve.

Speaker B:So it's an ongoing cycle.

Speaker B:Profit first is a journey.

Speaker B:Profit first is a lifetime journey and a cycle that we go on.

Speaker B:And it's always on a trajectory that takes you forwards and upwards and it's a proactive way of looking at life.

Speaker B:And certainly totally agree, you would not achieve what our members are achieving by producing management accounts for your clients.

Speaker B:Impossible.

Speaker B:So that's the word from us at Profit First Professionals.

Speaker B:Thank you for joining us on Profit first beyond the Book.

Speaker B:Jason, have you got any last words before we close off?

Speaker A:Yeah, I think that there is this emphasis on advisory, but if you don't have anything to say, when you get to the point of deciding to call yourself an advisor, you're not an advisor.

Speaker A:So the art of learning what those conversations actually is, what they can be, how to frame them, how to construct the value in those conversations is everything.

Speaker A:And I think one of the things that we do for you and I particularly Tim, on a Monday morning, taking people through the certification calls, the post certification calls, we are forever reinforcing how simple some of these structures and ideas are to be able to hold that transformative conversation with a client that really makes a difference to the client in their business.

Speaker A:This is natural kind of dialogue for you and I on a Monday morning.

Speaker A:We are talking about these things all the time.

Speaker A:So as much as there is a move towards it, number one, you've got to know what to say.

Speaker A:Number two, you've got to respect the value in what it is.

Speaker A:Number three, you've got to learn and do the iterations and the reps and learn, you know, from those of us internally within, within the membership who have trodden that path already.

Speaker A:You know, shortcutting new members ability to get to that point that took, you know, you and I years to do, Tim.

Speaker A: pect, you know, going back to: Speaker A:That's been a long learning curve for me as well.

Speaker A:But our ability to share and impart that information with people to make advisory simple, straightforward, easy structures, use the framework really I think is a core part of that process.

Speaker B:Thank you Jason.

Speaker B:Deb, any last words to wrap up with as well?

Speaker C:Yeah, reiterating what Jason said but with Profit first professionals are taught by other Profit first professionals.

Speaker C:So you're going through what you're will be implementing with your clients.

Speaker C:You're actually experiencing it firsthand with the being a Profit first member.

Speaker C:Your guides are Profit first professionals and we implement it in your business.

Speaker C:We teach you how to do the advisory, giving you first hand experience, you're immersed in it and therefore you have your handheld and not just set free.

Speaker C:You have your handheld when you start testing the water yourself and implementing it with your clients.

Speaker C:Yeah, there's no other, there's no better way to learn.

Speaker B:Totally agree.

Speaker B:And if you want to find out more about becoming a certified Profit first professional, hit the website profitfirstuk.co.uk and if you are serious you can join the wait list and I may, may book in a call with you.

Speaker B:We'll see if you're a good fit to join us.

Speaker B:Thanks for joining us again on the podcast Profit first beyond the Book.

Speaker B:Thanks Deb.

Speaker B:Thanks Jason.

Speaker B:See you soon.

Speaker A:Thanks Tim.

Speaker B:Thank you for joining us on our podcast today.

Speaker B:Profit first beyond the Book was brought to you by the Profit First Professionals UK and Ireland team.

Speaker B:If you'd like to find out more about Profit first or becoming a Profit First Professional, head to our website profitfirstuk.co uk.